Auditors’ dysfunctional behaviour and audit quality in Nigeria

Comportamento disfuncional dos auditores e qualidade da auditoria na Nigéria

Taiwo Hassan Odediran [1]

Temitope Olamide Fagbemi [2]

Abubakar Sadiq Kasum [3]

Ibidunni Elizabeth Daramola [4]

ABSTRACT

Auditors provide a third-party service by giving their judgement on a company's financial statements, which serve as the foundation for choices made by investors and other stakeholders. As a result of multiple audit failures not only in Nigeria, but also in Western countries, poor audit quality has led to a loss of confidence in the financial accounts attested to by auditors. The aim of this study was to investigate the impact of auditors' dysfunctional behaviours in Nigeria. The specific objectives of this study were to (i) investigate the effect of fear of loss of client on audit quality in Nigeria and (ii) investigate the effect of staff audit evaluation on audit quality in Nigeria. There were 3,323 audit firms in Nigeria, which represented the population of the research. The study used a survey research methodology and a random sampling procedure with the Taro Yamane sample size technique, resulting in 357 audit businesses throughout Nigeria's six geopolitical zones. The data was investigated using partial least squares structural equation modelling (PLS-SEM). According to the findings of the study, staff audit evaluation has a considerable positive effect on audit quality, whereas auditors' fear of losing clients, while positive, has an insignificant direct relationship with audit quality in Nigeria. However, the study concluded that auditors’ dysfunctional behaviour has a significant impediment to obtaining optimal audit quality. The study therefore recommended that audit partners and supervisors should always recognise the audit team's efforts, whether or not a misstatement is discovered. Furthermore, audit partners should always encourage their staff to adequately exercise necessary professional skill in their audit work.

Keywords: auditors’ dysfunctional behaviour; audit staff evaluation; audit quality.

RESUMO

Os auditores fornecem um serviço terceirizado ao dar seu julgamento sobre as demonstrações financeiras de uma empresa, que servem como base para escolhas feitas por investidores e outras partes interessadas. Como resultado de múltiplas falhas de auditoria não apenas na Nigéria, mas também em países ocidentais, a baixa qualidade da auditoria levou a uma perda de confiança nas contas financeiras atestadas pelos auditores. O objetivo deste estudo foi investigar o impacto dos comportamentos disfuncionais dos auditores na Nigéria. Os objetivos específicos deste estudo foram (i) investigar o efeito do medo da perda de cliente na qualidade da auditoria na Nigéria e (ii) investigar o efeito da avaliação da auditoria da equipe na qualidade da auditoria na Nigéria. Havia 3.323 empresas de auditoria na Nigéria, que representavam a população da pesquisa. O estudo usou uma metodologia de pesquisa de levantamento e um procedimento de amostragem aleatória com a técnica de tamanho de amostra Taro Yamane, resultando em 357 empresas de auditoria em todas as seis zonas geopolíticas da Nigéria. Os dados foram investigados usando modelagem de equações estruturais de mínimos quadrados parciais (PLS-SEM). De acordo com as descobertas do estudo, a avaliação da auditoria da equipe tem um efeito positivo considerável na qualidade da auditoria, enquanto o medo dos auditores de perder clientes, embora positivo, tem uma relação direta insignificante com a qualidade da auditoria na Nigéria. No entanto, o estudo concluiu que o comportamento disfuncional dos auditores tem um impedimento significativo para obter a qualidade ideal da auditoria. O estudo, portanto, recomendou que os parceiros de auditoria e supervisores devem sempre reconhecer os esforços da equipe de auditoria, independentemente de uma distorção ser descoberta ou não. Além disso, os parceiros de auditoria devem sempre encorajar sua equipe a exercer adequadamente a habilidade profissional necessária em seu trabalho de auditoria.

Palavras-chave: comportamento disfuncional dos auditores; avaliação do pessoal de auditoria; qualidade da auditoria.

1. Introduction

The issue of audit opinion quality on financial statements has been a cause for concern following the Enron accounting scandal in 2001 and the subsequent financial crisis that affected multiple organisations (Ajape et al., 2021). Dysfunctional audit behaviour is characterised as any behaviour that fails to conform to auditing requirements, as stated by Rostaminia et al. (2022). The presence of dysfunctional audit conduct poses a significant challenge to the auditing profession, leading to numerous instances of audit failures. The occurrence of audit failures within the auditing profession has resulted in increased public scrutiny and subsequently prompted auditing professionals to seek improvements in the auditing process (Rostaminia et al., 2022). The occurrence of dysfunctional behaviour among auditors can be seen as unethical conduct, which has detrimental effects on the overall quality of audits and casts a negative light on the reputation of the audit and accounting professions. The dysfunction among the audit staff was further intensified by the team leader's evaluation of the audit staff's performance, which was primarily influenced by the identification of misstatements. Additionally, the pressure to adhere to strict time budgets in the auditing process results in auditors inappropriately utilising their professional skills and prematurely concluding their assessments.

There is growing concern among accounting and auditing standard-setters, regulators, auditing professionals, and investors regarding the dysfunctional behaviour exhibited by high-level auditors within the practising auditor community. Previous studies have identified budget time restrictions, auditor-client conflict, and staff audit evaluation as potential manifestations of auditor dysfunctional behaviour. However, these factors have not been studied collectively and empirically in prior research. There has been stated concern among persons responsible for setting accounting and auditing standards, legislators, auditing professionals, and investors regarding the presence of high-level dysfunctional behaviour among practising auditors, which ultimately affects the quality of audits. While the occurrence of dysfunctional behaviour is not exclusive to the accounting and auditing professions, its ramifications extend to both local and worldwide markets (Nehme et al., 2019). The scrutiny of auditor actions is necessary due to their significant influence on the financial statements of firms (Baldacchino et al., 2016).

Moreover, prior research has examined the influence of many factors on maladaptive behaviour with the aim of enhancing the quality of audits within the auditing profession. Svanstrom (2016) conducted a study on the phenomenon of under-reporting of charged time and premature sign-off. In a similar vein, Rimende and Indarto (2021) conducted a study examining audit process changes, overcharging customers, obtaining insufficient evidence, and the influence of time budget pressure. The study conducted by Herda et al. (2019) examined the impact of supervisor coaching and workplace mindfulness on audit quality. The primary objective of this study was to examine the influence of auditor dysfunctional behaviour on audit quality within the context of Nigeria. Specifically, the study aimed to (i) explore the effects of staff audit evaluation on audit quality and (ii) investigate the effects of the fear of losing clients (a variable introduced in this study) on audit quality in Nigeria. The subsequent hypotheses were examined and formulated in a null format:

Ho1: Fear of loss of client does not significantly affect audit quality in Nigeria.

Ho2: Staff audit evaluation do not significantly influence audit quality in Nigeria.

2. Literature Review

The concept of audit quality refers to the degree to which an audit is conducted in accordance with professional standards and is able to provide reliable.Audit quality encompasses three key components: audit staff, audit techniques, and audit findings. According to Ajape et al. (2021), it is widely acknowledged among researchers that a quality audit may be achieved when the auditor's perspective is deemed trustworthy and is substantiated by sufficient and appropriate audit evidence that has been collected by a team of professionals possessing the requisite attributes. According to Asriningpuri and Gruben (2021), the concept of audit quality refers to the likelihood that a specific auditor would successfully find and disclose any instances of non-compliance within the client's accounting system. The technological prowess of the auditor, the specific audit techniques used, the scope of the sampling, and other pertinent considerations all have an impact on the likelihood that an auditor will find a breach. In essence, the concept of audit quality encompasses various interconnected elements that reflect the role of professional standards, auditor diligence, and auditor autonomy, alongside the characteristics of input, process, and output (Asriningpuri & Gruben, 2021).

The issue of audit quality has become a significant worry in the business sector as a result of corporate scandals. Auditors have faced accusations of ineptitude and a lack of independence in their ability to spot instances of illegal financial reporting, which have ultimately contributed to the downfall of companies (Ong et al., 2022). According to the authors, there exists a relationship between dysfunctional auditor behaviour and the quality of audits.

The phenomenon of dysfunctional audit behaviour refers to the occurrence of inappropriate or unethical actions by auditors during the performance of their duties.

Dysfunctional audit conduct is the term used to describe any behaviour that deviates from specified criteria. The inadequate and insufficient audit evidence obtained during the execution of audit procedures presents a significant challenge to the quality of audits, as it hinders the auditor's ability to form an opinion on the reasonableness of the financial statements under review (Asriningpuri & Gruben, 2021). The evaluation of personnel auditors has been examined in research investigating the impact of adopting professional scepticism. These studies have identified personnel auditors as those who apply their professional expertise to the identification of misstatements. It has been observed that these auditors are rewarded when they successfully identify misstatements but face penalties when they fail to discover misrepresentations. Consequently, the implementation of professional scepticism in practice has several consequences, including exceeding budgetary limits, encountering conflicts with managerial authorities, and the potential jeopardy of customer attrition resulting from the exercise of sceptical attitudes. According to Brazel et al. (2016), if a misstatement goes unnoticed despite the application of professional scepticism, audit staff supervisors may perceive it as a misuse of time and resources, potentially resulting in the expression of critical scepticism. Blix et al. (2021) assert that performance evaluations primarily focus on the subordinate's task outcomes. The apprehension around the potential loss of a client. This idea pertains to the probability of a client termination occurring due to the exercise of professional judgement by an auditor during the execution of their responsibilities. In order to effectively utilise their professional expertise, auditors are required to engage in a range of activities, including but not limited to posing inquiries, seeking additional information, detecting inaccuracies, evaluating the data collected, and undertaking many other responsibilities. Certain clients may express apprehension over these initiatives and thus withdraw their cooperation with the auditor. Hassas et al. (2018) suggest that the apprehension around auditors' customer attrition can be attributed to two primary factors: a dearth of clients and the emergence of smaller audit firms.

2.1 Literature Review

Agency theory is well recognised and extensively employed in the field of auditing. It serves as a framework for understanding the dynamics between shareholders and agents, and its primary purpose is to address the challenges arising from knowledge asymmetry (Ong et al., 2022). The theoretical framework of agency theory posits that individuals within an organisation are bound by contractual relationships, hence acknowledging the existence of two distinct groups: principals and agents. The auditors' reports were relied upon by both the company's shareholders and stakeholders in their decision-making processes. This theory holds significance in the context of this study due to its association with the role of independent examiners in evaluating financial statements. These examiners express their professional opinion on the accuracy and fairness of the financial information, which subsequently influences the investment, financial, and dividend decisions made by shareholders and stakeholders. The idea postulates that an agent bears a similar responsibility to their principal as auditors bear to the owners and stakeholders of firms. However, the theory does not offer a foundation for making strategic decisions within organisations.

Fishbein and Ajzen (1975) established the Theory of Reasoned Action (TRA). Insufficient empirical evidence was discovered to substantiate the hypothesis positing a correlation between attitude and behaviour in the study investigating this association. The study's findings indicate that the determinant of behaviour is the intention to perform, rather than attitude. Ajzen and Fishbein (1977) further developed the hypothesis. In 1991, the Theory of Planned Behaviour was expanded to incorporate the reasons that contribute to the dysfunctional behaviour of auditors, thus enhancing its conceptual framework. These ideas have unveiled a correlation between attitudes and behaviour as well as emphasised the significance of intention in shaping subsequent actions. The statement posits that the primary determinant of an individual's behaviour is purpose, which is shaped by their attitude and subjective norms. The theory of reasoned action and the theory of planned behaviour (Glanz et al., 2008) explicitly acknowledge the causal connection between attitudes, intentions, and behaviours. The aforementioned ideas were effectively applied in a research study that examined the role of individual ethical perspectives and intents in shaping individual behaviour (Fleischman & Valentine, 2019). This study is grounded in the theories of reasoned action (TRA) and planned behaviour (TPB) as it investigates the impact of auditors' dysfunctional behaviour on audit quality in Nigeria. The theories of the Theory of Reasoned Action (TRA) and the Theory of Planned Behaviour (TPB) exhibit a sufficient level of interconnectedness. In addition to disregarding certain situational factors that may influence the occurrence of atypical behaviour in individuals, these theories explicitly assert that the assessment of behavioural intention can effectively forecast an individual's likelihood of engaging in a specific action, assuming that behavioural intention remains constant and the behaviour in question is accurately predicted.

The user's text is already academic and does not require any rewriting. The present analysis aims to provide an empirical review of the existing literature. The study conducted by Svanstrom (2016) examined the correlation between perceived time pressure, training activities, and dysfunctional auditor behaviour within small audit businesses in Sweden. The findings of the study indicate a positive correlation between perceived time pressure and dysfunctional auditor behaviour, while a negative correlation is shown between participation in training events such as workshops and seminars and dysfunctional auditor behaviour. The study conducted by Majidah and Yane (2016) investigated the relationship between audit quality and many factors, including time budget strain, dysfunctional auditor behaviour, and the moderating role of information technology understanding. The objectives of this study are to examine (1) the impact of time budget pressure on dysfunctional behaviour, (2) the role of information technology in moderating the relationship between time budget pressure and dysfunctional auditor behaviour, (3) the effect of time budget pressure on audit quality, and (4) the effect of dysfunctional auditor behaviour on audit quality. The focus of this study pertains to auditing firms operating on the island of Java that have been duly registered with the Financial Services Authority. The data was gathered using convenience sampling, employing sample methodologies, resulting in a total of 20 data points. The statistical analysis included two regression techniques, namely simple regression and regression with a moderating variable. The impact of time budget pressure on dysfunctional auditor behaviour, including behaviours such as reducing audit quality, under-reporting of time, and premature sign-off, is influenced by the level of understanding of information technology. Additionally, this study finds that time budget pressure does not directly affect audit quality. However, it is important to note that dysfunctional auditor behaviour does have an influence on audit quality, particularly when considering the role of information technology. The study conducted by Johansen and Christoffersen (2017) investigated the correlation between dysfunctional auditor behaviour and three assessment foci, namely an efficiency focus, a client focus, and a quality focus. The findings of this study, derived from the analysis of responses obtained from a sample of 196 auditors, indicate that there is no significant correlation between an emphasis on efficiency and the occurrence of dysfunctional behaviour. Research has indicated a correlation between a client-centric approach and the manifestation of maladaptive behaviour. Ultimately, and arguably of utmost significance, our findings indicate the potential for mitigating maladaptive tendencies by prioritising quality in performance assessments. The findings of our study offer valuable information for professionals and regulatory bodies regarding the impact of performance evaluations on both the promotion and mitigation of dysfunctional auditor behaviours. Our research provides three significant contributions. The study demonstrates that the negative consequences associated with a focus on efficiency are not evident in the sample under investigation. The study additionally illustrates that an emphasis on client satisfaction is correlated with maladaptive conduct, whereas an emphasis on quality is correlated with reduced maladaptive behaviour. The study ultimately demonstrates a higher prevalence of performance evaluation issues and dysfunctional behaviour among auditors in lower ranks. Specifically, the findings indicate that the sub-sample consisting of less experienced auditors (staff auditors with an average experience level slightly exceeding five years) differs from the results obtained from the sub-sample of managers (with an average experience level slightly exceeding ten years). In a study conducted by Brazel et al. (2018), the researchers examined the correlation between sceptical behaviour and the influence of budget overruns on sceptical evaluations and behaviours in the budget file as a consequence of audit staff assessments. The research utilised an experimental approach, with the inclusion of audit seniors from two of the leading accounting firms globally. Two empirical studies were conducted to assess the proficiency of individual employees in detecting errors and non-errors. These investigations focused on the expertise and job roles of audit personnel inside a prominent global accounting organisation. The study's findings indicate that the use of professional expertise leads to budgetary overruns due to the increased need for testing, which in turn incurs additional testing expenditures. The study conducted by Monoarfa and Gorontalo (2018) had two main objectives: (1) to examine the combined influence of time budget pressure and dysfunctional behaviour on audit quality, and (2) to investigate the individual effects of time budget pressure and dysfunctional behaviour on audit quality. The population under investigation in this study comprises auditors employed by the offices of BAWASDA in Gorontalo Province. The study employed a census methodology, utilising data gathering approaches such as the distribution and completion of questionnaires as well as conducting direct interviews. The hypotheses in this study were evaluated by the application of path analysis. The findings of the research indicate that there is a concurrent and partial impact of time budget pressure and dysfunctional behaviour on audit quality. This implies that as time budget constraints increase in conjunction with consistent dysfunctional behaviours, the quality of the audit is further diminished. The study also indicates that time budget pressure has a minor influence on the quality of audits. The route coefficient indicates a negative relationship between the X1 variable and the Y variable, indicating a directional influence. This implies that when time and budget pressure increase, the quality of the audit decreases. This study also demonstrates that dysfunctional behaviour partially impacts the quality of udits. The route coefficient indicates a negative relationship between the X2 variable and the Y variable, indicating a direction of impact from X2 to Y. This implies that there is an inverse relationship between the level of dysfunctional behaviour and the quality of the audit. One of the factors used to assess the performance of the audit team is the identification of misstatements, the ability to complete the audit within the designated timeframe, and the evaluation of efficiency focus (Tjan, 2019). In a study conducted by Haris (2019), the impact of performance evaluation, organisational-professional disputes, and professional scepticism on audit judgement was examined, with a particular focus on dysfunctional behaviour. The experimental study provided confirmation of the link between professional scepticism, organisational professional conflict, and performance appraisal towards audit judgement, with the presence of auditor dysfunctional behaviour acting as a moderating factor. The findings of the study indicate that there is a significant relationship between organisational professional conflict, professional scepticism, performance evaluation, audit judgement, and audit quality. In a similar vein, the study conducted by Fleischman and Valentine (2019) examined the impact of outcome knowledge on individual ethical beliefs and behavioural intentions. This study investigated the ethical setting, attitudes towards ethical behaviour, and opinions on ethical behaviour in relation to arbitrary social standards. The conclusion was bolstered by the finding that participants exhibit a reduced level of moral condemnation towards unethical conduct, as well as the discovery that the implementation of an intimidating managerial strategy leads to a transformation of organisational outcomes from unfavourable to favourable. Tjan's (2019) study examined many aspects of time budget strain, with a particular focus on the examination of performance quality attention and its influence on auditors' utilisation of their expertise. Consequently, the assessment methodology influences the manner in which individuals approach the task of conducting an audit. Rajabdorri and Khanizalan (2020) conducted a study that proposed a robust and inverse relationship between auditor performance and premature sign-off as well as under-reporting of chargeable time. The study found that higher levels of premature sign-off and under-reporting of chargeable time were associated with decreased auditor performance. In their study, Nehme et al. (2021) explored auditors' perceptions of dysfunctional behaviour and its underlying causes. The researchers identified three factors that could potentially aid practitioners in comprehending the reasons behind auditors' engagement in dysfunctional behaviour and implementing preventive measures. These factors include working independently, collaborating with internal auditors, and conducting box-ticking exercises.

When faced with time constraints, Asriningpuri and Gruben's study (2021) investigates the effect of auditor misconduct on the caliber of audits. This study further examines the correlation between dysfunctional auditory behaviour and time budget pressure. The present study employed a design and technique that involved conducting structured interviews with four auditors employed at Chris Hermawan Public Accountant Firm, situated in Bandung, Indonesia. The findings of this study indicate that time budget pressure has a significant influence on the occurrence of dysfunctional audit behaviour. Specifically, it is seen that time budget pressure leads to premature sign-offs, inadequate implementation of audit procedures, and insufficient gathering of evidence. The concept of pressure, specifically in relation to time budget, encompasses a range of consequences for individual behaviour, which can be both advantageous and disadvantageous. The presence of pressure can elicit either dysfunctional behaviour or serve as a motivating force, prompting individuals to use their utmost effort in tackling challenging tasks that demand significant energy and exertion to resolve issues. Nevertheless, in the event that an individual experiences an undue amount of pressure, their job performance may be adversely affected, leading to the manifestation of dysfunctional behaviour. Furthermore, the findings of this study suggest that the presence of dysfunctional audit behaviour has a detrimental impact on the overall quality of audits. The escalation of dysfunctional behaviour is anticipated to have a negative impact on the auditor's capacity to detect significant misstatements in the financial statement. Hence, the presence of dysfunctional audit behaviour can lead to a decline in audit quality, thereby affecting the auditing profession. The study conducted by Ong et al. (2022) aimed to examine and analyse the factors that could potentially contribute to impaired auditor behaviour and a decline in the quality of audits. This study examines the impact of time limitations, work complexity, and client priority on dysfunctional auditor behaviour and audit quality within the context of Malaysia. The poll consisted of 133 participants who were selected using the snowball sampling method. The findings demonstrate that individual auditors may be inclined to tolerate dysfunctional activity as a result of factors such as time constraints, budgetary pressures, and the difficulty of the task at hand. Contrary to expectations, the significance of clients does not compromise the independence of auditors. Auditors fulfil a crucial function in upholding the integrity of audit reports and reinstating public confidence in the audit field, since they possess the authority to provide assurance on financial statements. The user did not provide any text to rewrite. The study conducted by Kaawaase et al. (2021) examined variations in audit quality across different audit firms operating in Uganda. The authors specifically investigate the underlying assumption of notable disparities in audit quality between large audit firms, commonly referred to as the Big 4, and small and medium practices (SMPs). In this study, the researchers construct measurement tools to evaluate the perceived quality of audits in the financial services industry. These scales are derived from qualitative data collected from a sample of 106 audit practitioners, 31 credit analysts, and 13 board members. The authors employ the software NVivo© to conduct an analysis of the 13 transcribed interviews. They utilise a method known as "cross-case analysis" to visually represent the various dimensions and scales of audit quality. The authors employed measurement tools that were previously created to gather quantitative data from a sample of 183 board members and top executives in the financial services sector. They then conducted a statistical analysis, specifically a Mann-Whitney U test, to examine potential variations in perceived audit quality among different audit firms. The results indicate that the concept of audit quality encompasses various aspects, including the extent of discretionary accruals, the adherence of audited financial statements to accounting standards, laws, and regulations, as well as the level of audit fees. Based on the metrics employed, the authors ascertain that Big 4 audit firms exhibit a higher degree of adherence to accounting standards, legal statutes, and additional regulatory obligations in comparison to SMPs. However, when considering all three characteristics of audit quality collectively, there are no statistically significant disparities in audit quality levels between the Big 4 accounting firms and small and medium-sized practices (SMPs). The study conducted by Blum et al. (2022) examined the impact of staff reputation on behaviour related to audit quality. The results indicated that auditors' perceptions of their reputation significantly influence their decision to engage in conduct that is associated with audit quality. In a study conducted by Annelin (2023), the relationship between audit quality-threatening behaviour (AQTB) and three dimensions of team equality, namely de-individuation, social identity, and gender equality, was investigated. A survey was administered at a prominent audit company belonging to the Big 4 in Sweden. The hypotheses were examined through the use of ordered logistic regression and a partial least squares structural equation model. The study's findings indicate that audit teams that undergo de-individuation tend to engage in a greater number of aggressive questioning tactics during audits. Conversely, audit teams characterised by a stronger social identity tend to exhibit a lower frequency of aggressive questioning tactics during audits. Nevertheless, the social identity of the audit team has the potential to moderate the audit team's encounter with de-individuation and hence decrease the occurrence of audit quality-threatening behaviours (AQTB). The objective of the study conducted by Rostaminia et al. (2022) is to develop a conceptual framework that elucidates the factors influencing dysfunctional audit behaviour in Iran, taking into account the environmental characteristics and the state of the audit profession. The statistical population of this study encompasses individuals who hold positions as partners and managers inside auditing companies, managers within the audit organisation, managers within institutions responsible for overseeing the audit profession, and other professionals specialising in the topic of audit quality. In-depth interviews were conducted using the snowball sampling approach. Following the completion of 16 interviews with a panel of experts, the research team has ascertained that the data obtained has achieved saturation, indicating that further interviews are unnecessary. This research has employed the systematic approach, which is one of the three ways (systematic, emergent, and constructivist) commonly used in foundation theorising. The findings present a comprehensive and suitable framework for understanding the factors that influence the Iranian auditing profession. The present model encompasses various elements, namely causal conditions, intervening factors, contextual conditions, and tactics, all of which are associated with inefficient audit behaviour and its subsequent effects. This study presents the research model in two distinct ways. Firstly, the graphic illustrates the pattern of ineffective audit behaviour, followed by a subsequent explanation. The findings indicate that the factors influencing dysfunctional audit conduct include the professional ethics of partners and responsible managers, the knowledge and experience of partners and responsible managers, and the planning, control, and supervision processes. Professional ethics stands out as the foremost influential component among the other causative factors. The intervening variables encompassed various factors, including the auditors' ability to effectively ensure accountability, the implementation of community quality control measures, the alignment of labour market conditions with the profession's requirements, economic pressures, the institutional framework in place, the individuals' commitment to remaining in the profession, and the presence of time constraints. The contextual aspects encompassed in this study comprise the distinction between public and private economies, the cultural inclination towards participation, and the evolution of the auditing profession. The primary focus of this study revolves around the concept of dysfunctional audit behaviour, which occupies a core position within the model, with other categories being interconnected to it. One of the weaknesses observed in professional ethics is the insufficiency of knowledge and experience among responsible partners and managers. This deficiency, along with a lack of planning and monitoring, has resulted in the implementation of the following strategies: 1) The act of circumventing the complete audit procedure Presenting positive assessments of the employer's viewpoint. In conclusion, based on the findings of the study, the primary ramifications of the auditor's dysfunctional conduct encompass the inability to detect crucial distortions, a decline in audit quality characterised by the failure to identify significant distortions, a deterioration in the societal perception of the auditing profession, diminished financial transparency and economic well-being within society, and suboptimal resource allocation. In conclusion, recommendations are offered based on the findings of the study.

The study conducted by Astuty et al. (2022) investigated the effects of due professional care, time budget pressure, and dysfunctional behaviour on the quality of audits. The nature of this research is associative. The study sample consisted of auditors employed at the public accounting firm located in Medan City. The sampling procedure employed in this study was simple random sampling, which involved selecting participants in a random manner. The number of samples required for the study was determined using Slovin's method, resulting in a total of 101 auditors being included in the sample. The data gathering method employed in this study involved the administration of a questionnaire, whereas the data analysis approach utilised was multiple linear regression analysis. The findings of this study suggest that the provision of adequate professional care positively influences the quality of audits. Additionally, the presence of time and budget pressure is shown to have a good impact on audit quality. Conversely, the occurrence of dysfunctional behaviour is seen to have a detrimental effect on audit quality.

3. Conceptual Framework

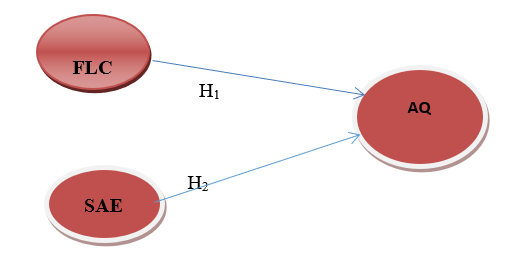

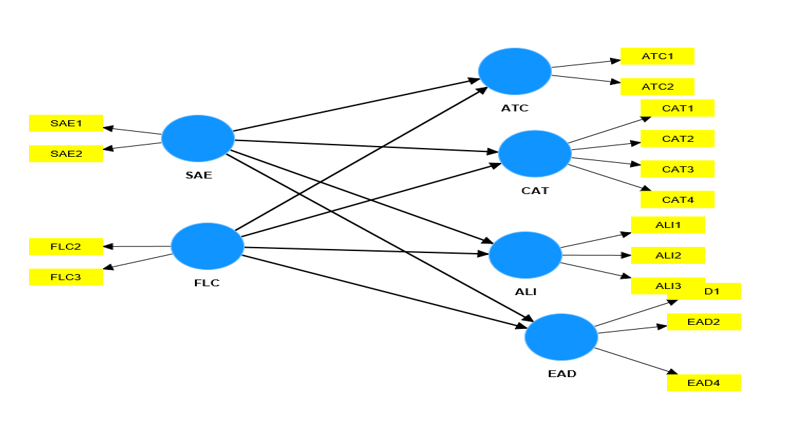

The conceptual model consists of detailed variables (dependent and independent) of this study and their direct effect on audit quality. The model reflects interactions between indicators of costs of exercising professional expertise and audit quality. The hypothesised relationship is depicted in Figure 1.

Figure 1: Hypothesised Structural Equation Model

The dependent variable in Figure 1 is Audit Quality, denoted as AQ. The latent variable of auditors' dysfunctional conduct (ADB) was assessed using two variables: fear of losing clients (FLC) and appraisal of staff auditors (SAE). The arrows representing the movement from FLC and SAE, which are independent latent variables, to audit quality (AQ), indicate that these two latent factors were being examined for their direct impact on audit quality.

The present study will employ a rigorous methodology to investigate the research question at hand. The chosen methodology will ensure the collection of reliable and

The research employed a survey approach, utilising questionnaires to collect data from various segments of the target population, encompassing audit partners, audit managers, and audit seniors inside Nigerian audit firms. Quantitative research methods were employed due to their capacity to facilitate efficient evaluation, examination, and data analysis of extensive datasets, hence enhancing precision. The research employed quantitative data obtained from a primary source through the administration of questionnaires to auditors in Nigeria who are employed in audit firms. The study employed a questionnaire as a means of gathering data on dysfunctional behaviour among auditors. The questionnaire was adapted from previous research conducted by Brazel et al. (2018; 2016) on the topic, as well as from a study by Kusumawati and Syamsuddin (2018) on audit quality. To ensure a wide reach of participants, an online survey was employed.

The population of this survey consisted of 3,323 active audit firms in Nigeria. The active practising firms of the Association of National Accountants of Nigeria and the Institute of Chartered Accountants of Nigeria are as follows. The population under research consisted of audit partners, audit managers, and audit seniors, serving as the unit of analysis. Therefore, the sample size for the administration of the questionnaire in this study was determined using Taro Yamane's formula for sample size determination. The study's sample consisted of 357 active audit firms in Nigeria, selected using a random sampling approach.

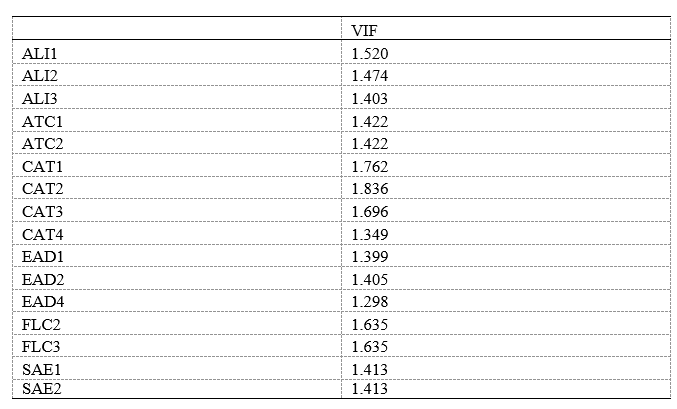

The specification of the model is presented in this section.

This research utilises the empirical model developed by Fleischman and Valentine (2019), which aligns with the theory of reasoned action and attribution theory. The objective of this study is to investigate the impact of the expense associated with exercising professional knowledge on the quality of audits. The dependent variable, audit quality, is represented as a function of the independent variables, specifically the cost associated with exercising professional knowledge, as denoted in equation (2).

The dependent variable for this study, which is audit quality, was measured using the audit team's competence (ATC), the team members' commitment (CAT), the audit leader's involvement in the audit engagement (ALI), and the efficiency of the audit documentation (EAD). However, the staff audit evaluation (SAE), which has been established by the researchers, and the fear of losing clients (FLC), which has been recorded in the literature, both measure the dysfunctional behaviour of auditors and serve as the independent variables. The partial least square structural equation model (PLS-SEM) was used to analyse data of this study.

4. Results and Discussion

4.1 Preliminary Assessments

4.1.1 Assessment of the Measurement Model

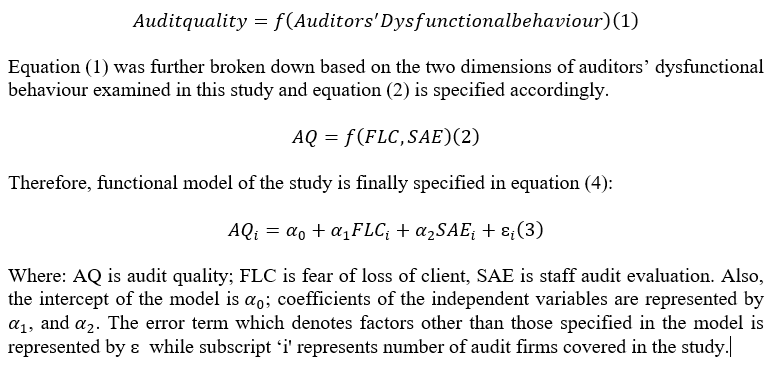

In the factor loading given in Table 1, all of the constructs have factor loading values larger than 0.7. The factor loading threshold for constructs and indicators has been reached. As a result, the shared variance between the construct and its indicators is greater than the variance of the error term of 0.5 used in this study because no items in the sample had factor loadings less than 0.50 after removing the construct of ATE and its indicators for failing to meet the threshold (Table 1).

Table 1: Factor Loading

Source: Authors’ Computation, 2023

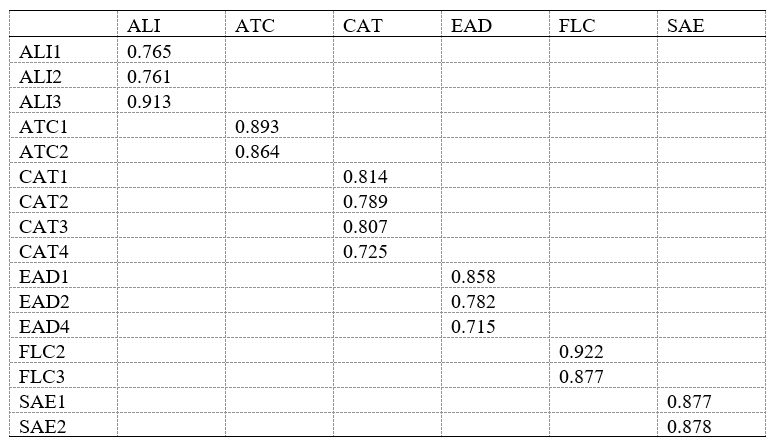

Furthermore, according to Fornell and Bookstein (1982), the variance inflation factor (VIF) is used to calculate multicollinearity indicators. According to Hair et al. (2016), multicollinearity is not a significant issue if VIF is less than 0.5. The VIF value for the study's indicators is higher than the suggested threshold, and as a result, the results are presented in Table 2.

Table 2: Multicollinearity Indicators (VIF)

Source: Authors’ Computation, 2023

Figure 2: Measurement Model Assessment

Source: Authors’ Computation, 2023

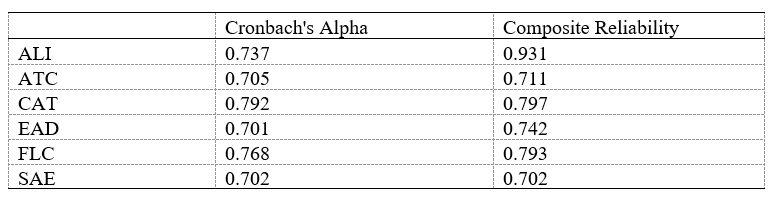

4.1.2 Reliability Analysis

Cronbach's Alpha and composite reliability were employed in the study to assess the internal consistency of the components. The results of the tests, as given in Table 3, reveal that all variables exceed the recommended Cronbach's Alpha threshold level (> 0.70), and all constructs likewise exceed the suggested minimum level (> 0.70) for composite reliability. Cronbach's Alpha ranged from 0.701 to 0.792, while composite reliability ranged from 0.702 to 0.931. The dependability statistics for the two reliability indicators are above the acceptable level of.70 (Hair et al., 2011). As a result, the dependability of the construction is proven.

Table 3: Construct Reliability Analysis (Cronbach’s Alpha and Composite Reliability)

Source: Authors’ Computation, 2023

4.1.3 Construct Validity

When convergent validity and discriminant validity are established, construct validity is established, especially when PLS-SEM is used in the data analysis.

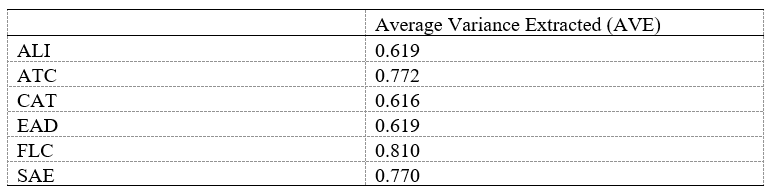

4.1.4 Convergent Validity

The Average Variance Extracted (AVE) criterion was used to assess convergent validity, as proposed by Fornell and Bookstein (1982). The AVE measures a construct's ability to explain variance in its indicators, as well as how much of that variance can be attributable to measurement error. The AVE results revealed that the construct's indicators were related to one another and that the variation of the construct could account for nearly all of the variance in the indicators. The AVE threshold should be at least 0.5, preferably more. The AVEs obtained excellent results from the measurement model used in this study, demonstrating that convergent validity was established (see Table 4).

Table 4: Construct Convergent Validity

Source: Authors’ Computation, 2023

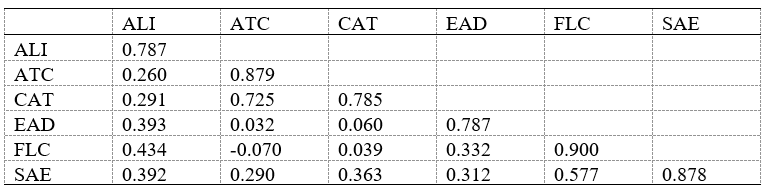

4.1.5 Discriminant Validity

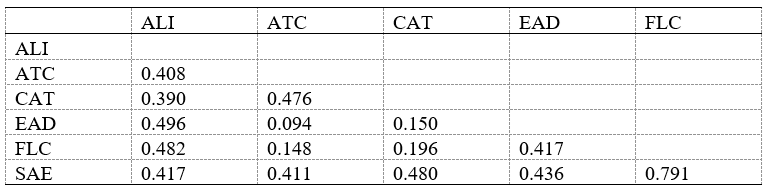

The discriminant validity of a construct indicates how distinct it is from the other constructs in the model. According to the Fornell-Lacker criterion, diagonal figures are greater than off-diagonal ones below them. This suggests that Fornell and Bookstein's (1982) recommendation of discriminant validity was reached, and evidence of discriminant validity was presented. It also demonstrates that the correlation between constructs was greater than the correlation between square roots. The Fornell-Larcker Creterion results are shown in Table 5.

Table 5. Discriminant Validity: Fornell-Larker Creterion

Source: Authors’ Computation, 2023

4.1.6 Heterotrait-Monotrait Ratio

According to Henseler et al. (2015), neither the Fornell-Larcker criterion nor the evaluation of cross-loadings can correctly detect concerns with discriminant validity. The researchers proposed the Heterotrait-Monotrait ratio (HTMT) as a new metric for discriminant validity. The HTMT ratio should be smaller than 0.85 as a criterion to support discriminant validity. The results in Table 6 reveal that the HTMT criteria have been met. The validity and reliability of the reflectively measured constructs are thus supported, and all model evaluation conditions are met.

Table 6: Discriminant Validity: Heterotrait Monotrait Ratio (HTMT)

Source: Authors’ Computation, 2023

- Assessment of the Structural Model

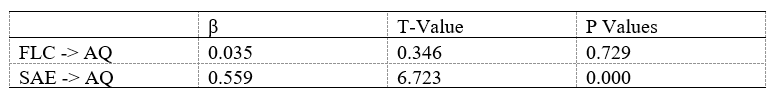

The evaluation of structural models considers how various variables interact with one another. To accomplish this, the researchers examined path coefficients from independent variables to dependent variables and validated higher-order constructs. There was an investigation investigating the direct relationship between FLC and AQ and between SAE and AQ. Path coefficients were used to assess the concept connection. The bootstrapping approach was used over 5,000 iterations with no sign changes to analyse the significance links of all constructs (Clauss, 2017; Hair, 2011; see Table 7).

Table 7: Path Coefficients

Source: Authors’ Computation, 2023

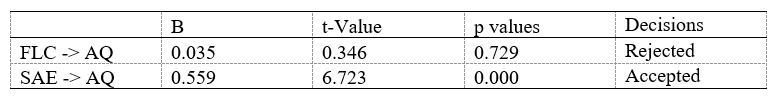

- Hypothesis Testing

This study examined the research hypotheses using the value of the construct's path coefficients, and the results are shown in Table 8. Ho1 and Ho2 investigate whether fear of loss of client and audit staff evaluation have a substantial impact on audit quality in Nigeria. The analysis revealed that, while fear of loss of client (Ho1) is positive, it has no significant effect on audit quality with = 0.035, t = 0.346, at p > 0.05, whereas audit staff evaluation (Ho2) has a significant positive effect on audit quality with = 0.559, t = 6.723, at p < 0.001. As a result, Ho1 is supported whereas Ho2is not.

Table 8: Summary of Test of Hypothesis

Source: Authors’ Computation, 2023

- Discussion of Results

This study examined the effect of auditors’ dysfunctional behaviour on audit quality in Nigeria. The hypotheses Ho1, and Ho2 were set to investigate the significance of auditor’s fear of loss of client and staff audit evaluation on audit quality. The study discovered that staff audit evaluation has significant positive effect on audit quality with p-value <0.001 at a coefficient of 0.559 indicating that staff audit evaluation variable correlate positively and have a significant direct effect on audit quality. Hence, Ho1 is not supported whereas auditor’s fear of losing client though positive but has insignificant direct relationship with audit quality with p-value >0.05 and regression coefficient of 0.035.

These findings have the implication that the audit quality will be higher the more professional expertise the auditor employs without bias or compromise. Regardless of whether a misstatement is found, auditors should be cautious when engaging in conflict with their clients. Supervisors and audit partners ought to appreciate the efforts made by their audit staff to ensure high-quality work. The findings of this study corroborated Haris's (2019) assertion that the audit quality is significantly influenced by the staff auditor's evaluation.

According to a study by Blum et al. (2022), auditors frequently use their professional competence at a cost when performing their tasks, and their perception of their reputation affects whether or not they choose to engage in audit quality-related behaviour. Therefore, auditors should not let their fear of losing clients stop them from using reasonable professional scepticism.

- Conclusion and Recommendations

This study is an extension of research on auditor’s dysfunctional behaviour. According to the study's findings, audit staff evaluation has significant effect on audit quality whereas auditor’s fear of loss of client has insignificant effect on audit quality. This showed that audit staff motivation as well as encouragement either misstatement is found or not is necessary for audit staff to maintaining auditing professionalism in audit work. Consequently, the insignificancy of auditor’s fear of loss of client on audit quality revealed that reputations of auditors are the top most priority of auditors. Hence, the fear of losing a client has little or no impact on the quality of an audit, particularly for auditors who value their image and do not compromise audit quality to professional ethics. Therefore, auditors' dysfunctional behaviour is very critical to audit quality.

According to the findings of this study, audit partners and supervisors should always recognise the audit team's efforts, whether or not a misstatement is discovered. As a result, the audit team that carried out the audit exercise should be commended for their dedication to due professional care. Furthermore, fear of losing a customer should not deter auditors from using professional scepticism when completing their audit duties as mandated by international auditing standards (ISA 200). The International Auditing and Assurance Standards Board (IAASB) believes that high-quality, robust, and operable international standards contribute to improved engagement quality and consistency of practice around the world, as well as increased public trust in the global auditing and assurance profession.

References

Ajape, K. M., Adeleye A. O., Salawu, M. W., & Ogunleye, O. J. (2021). Audit quality and financial reporting quality: evidence from Nigeria. Proceedings of the 7th Annual International Academic Conference on Accounting and Finance Disruptive Technology: Accounting Practices, Financial and Sustainability Reporting (1-20).

Annelin, A. (2023). Audit team equality and audit quality threatening behaviour. Managerial Auditing Journal, 38(2), 158-185. https://doi.org/10.1108/MAJ-08-2021-3288

Asriningpuri, G. P., & Gruben, F. (2021). The effect of time budget pressure and dysfunctional auditor behaviour on audit quality: a case study in an audit firm in Indonesia. Diponegoro Journal of Accounting, 10(4), 1-12.

Astuty, W., Anindya, D. A., Ovami, D. C., & Pasaribu, F. (2022). The impact of due professional care, time budget pressure and dysfunctional behaviour on audit quality. Academy of Entrepreneurship Journal, 28(1), 1-12.

Baldacchino, P. J., Tabone, N., Agius, J., & Bezzina, F. (2016). Organizational culture, personnel characteristics and dysfunctional audit behaviour. IUP Journal of Accounting Research & Audit Practices, 15(3), 34. Endanger

Blix, L. H., Chui, L. C., Pike, B. J., & Robinson, S. N. (2021). Improving auditor performance evaluations: The impact on self‐esteem, professional skepticism, and audit quality. Journal of Corporate Accounting & Finance, 32(4), 84-98.

Blum, E. S., Hatfield, R. C., & Houston, R. W. (2022). The effect of staff auditor reputation on audit quality enhancing actions. The Accounting Review, 97(1), 75-97.

Brazel, J. F., Gimbar, C., Maksymov, E. & Schaefer, T. J. (2018). The outcome effect and professional skepticism: A replication and a failed attempt at mitigation. American Accounting Association Preprint Accepted Manuscript.

Brazel, J. F., Jackson, S. B., Schaefer, T. J. & Stewart, B. W. (2016). The outcome effect and professional skepticism. The Accounting Review, 91(6), 1577-1599.

Clauss, T. (2017). Measuring business model innovation: conceptualization, scale development, and proof of performance. R & D Management, 47(3), 385-403.

Fleischman, G. M., & Valentine, S. R. (2019). How outcome information affects ethical attitudes and intentions to behave. Behavioural Research in Accounting, 31(2), 1-15.

Fornell, C., & Bookstein, F. L. (1982). Two structural equation models: LISREL and PLS applied to consumer exit-voice theory. Journal of Marketing Research, 19(4), 440-452.

Glanz, K., Rimer, B. K., & Viswanath, K. (Eds.). (2008). Health behaviour and health education: Theory, research, and practice. John Wiley & Sons.

Hair, J. F., Ringle, C. M., & Sarstedt, M. (2011). PLS-SEM: Indeed a silver bullet. Journal of Marketing theory and Practice, 19(2), 139-152.

Hair, Jr, J. F., Sarstedt, M., Matthews, L. M., & Ringle, C. M. (2016). Identifying and treating unobserved heterogeneity with FIMIX-PLS: part I–method. European business review, 28(1), 63-76.

Haris, N. S. (2019). Effects of professional skepticism, organizational: Professional conflicts and performance evaluation toward audit judgement through auditor dysfunctional behaviour. Journal of Finance and accounting 10(8), 165-173.

Hassas Yeganeh, Y., Malekian Kale Basti, E., & Tavakolnia, E. (2018). An Attitude to Auditor’s Fear of Losing the Client; Emphasizing on Management Performance Audit. Journal of Management Accounting and Auditing Knowledge, 7(26), 209-220.

Henseler, J., Ringle, C. M., & Sarstedt, M. (2015). A new criterion for assessing discriminant validity in variance-based structural equation modeling. Journal of the academy of marketing science, 43(1), 115-135.

Herda, D. N., Cannon, N. H., & Young, R. F. (2019). Workplace mindfulness and its effect on staff auditors’ audit quality: Threatening behaviour. Behavioural Research in Accounting, 31(1), 55-64.

Johansen, R. T., & Christoffersen, J. (2017). Performance evaluations in audit firms: Evaluation foci and dysfunctional behaviour. International Journal of Auditing, 21(1), 24-37. https://doi.org/10.1111/ijau.12079

Kaawaase, T. K., Assad, M. J., Kitindi, E. G., & Nkundabanyanga, S. K. (2016). Audit quality differences amongst audit firms in a developing economy. Journal of Accounting in Emerging Economies, 6(3), 269-290. http://dx.doi.org/10.1108/JAEE-08-2013-0041

Kusumawati, A., & Syamsuddin, S. (2018). The effect of auditor quality to professional skepticsm and its relationship to audit quality. International Journal of Law and Management, 60(4), 998-1008.

Majidah, D. I., Yane D. A., OR Anna, Y. D. (2016). Audit quality: time budget pressure, dysfunctional auditor behaviour and the understanding of information technlogy as moderator. The 7th Smart Collaboration for Business in Technology and Information Industries (295-301).

Monoarfa, R., & Gorontalo, H. D. (2018). The influence of time budget pressure and dysfunctional behaviour to audit quality at Bawasda in Gorontalo Province. Jurnal Akuntansi, 12(3), 420-436.

Nehme, R., AlKhoury, C., & AlMutawa, A. (2019). Evaluating the performance of auditors: a driver or a stabilizer of auditors’ behaviour. International Journal of Productivity and Performance Management. DOI 10.1108/IJPPM-08-2018-0306

Nehme, R., Michael, A., & Haslam, J. (2021). The impact of time budget and time deadline pressures on audit behaviour: UK evidence. Meditari Accountancy Research, 30(2), 245-266.

Ong, T. S., Teh, B. H., Sim, G. K., Ng, S. H., & Hossain, M. I. (2022). Does dysfunctional behaviour matter when it comes to audit quality in Malaysia? Asian Journal of Accounting and Governance, 17, 1–12. http://dx.doi.org/10.17576/AJAG-2022-17-01

Rajabdorri, H., & Khanizalan, A. (2020). The effect of premature sign-off and under-reporting of chargeable time of audit on the performance of auditors. Innovation Management and Operational Strategies, 1(2), 157-170.

Rimende, J., & Indarto, S. L. (2021). Analysis Of Factors Influencing Premature Sign Off: Locus of Control As Moderating Variable. International Journal of Business and Economy, 3(4), 227-240.

Rostaminia, R., Hejazi, R., Hasanzadeh, R. B., & Talebnia, G. (2022). A model of dysfunctional audit behaviour. Journal of Accounting Knowledge, 13, (4), 91-115. https://doi.org/ 10.22103/jak.2022.18344.3595

Svanstrom, T. (2016). Time pressure, training activities and dysfunctional auditor behaviour: evidence from small audit firms. International Journal of Auditing, 20(1), 42-51.

Tjan, J. S. (2019). An analysis of the factors which influence dysfunctional auditor behaviour. Problems and Perspectives in Management, 19(1), 216-224.

Fishbein, M., & Ajzen, I. (1975). Belief, Attitude, Intention, and Behavior: An Introduction to Theory and Research.Addison-Wesley Publishing Company, Inc. https://www.researchgate.net/publication/233897090_Belief_attitude_intention_and_behaviour_An_introduction_to_theory_and_research

Ajzen, I. & Fishbein, M. (1977). Attitude-behaviour relations: A theoretical analysis and review empirical research. Psychological Bulletin, 84(5), 888-918

Recebido: 27/09/2024

Aceito: 22/10/2024

------------

Notas

[1] Department of Accounting, Faculty of Management Sciences, University of Ilorin, Ilorin, Nigeria. costmaster15@gmail.com ORCID: https://orcid.org/0009-0002-6098-151X

[2] Department of Accounting, Faculty of Management Sciences, University of Ilorin, Ilorin, Nigeria. olamidefag@yahoo.com ORCID: https://orcid.org/0000-0002-5755-902X

[3] Department of Accounting, Faculty of Management Sciences, University of Ilorin, Ilorin, Nigeria. abusk@unilorin.edu.ng ORCID: https://orcid.org/0000-0002-5644-1687

[4] Department of Accounting, Faculty of Management Sciences, University of Ilorin, Ilorin, Nigeria. ibidundara@gmail.com ORCID: https://orcid.org/0000-0002-4496-208X