Macroeconomic variables and stock returns of London Stock Exchange

Variáveis macroeconômicas e retornos das ações da Bolsa de Valores de Londres

Kayode Kolawole [1]

Oluwagbenga Seyingbo [2]

Bashirat Oloyin-Abdulhakeem [3]

Adeshola Haliru [4]

Usman Osunkunle [5]

ABSTRACT

This study examined impact of macroeconomic variables on stock returns of London Stock Exchange. The study considered data of secondary nature which was obtained from World Development Indicator, London Stock Exchange, Bloomberg databases and The Office for National Statistics. The data were subjected to autoregressive distributed lags (ARDL) models and Granger causality test. The study found a positive relationship between gross domestic product (GDP) and stock returns. It was revealed that inflation has a negative relationship with stock returns with coefficient value of 0.621885 at 5% confidence level. Additionally, the study revealed an inverse relationship between interest rates and stock returns with coefficient value of -0.659179 at 5% confidence level. Finally, the study revealed positive relationship between foreign portfolio investment and the stock returns with coefficient value of 1.006504 at 5% confidence level. The study concluded that macroeconomic variables affect stock returns of LSE. The study therefore recommends that government should manage the macroeconomic variables in such a way that will improve the performance of stock market.

Keywords: Macroeconomic Variables; Stock Returns; London Stock Exchange

RESUMO

Este estudo examinou o impacto das variáveis macroeconômicas nos retornos das ações da Bolsa de Valores de Londres. O estudo considerou dados de natureza secundária obtidos do Indicador de Desenvolvimento Mundial, da Bolsa de Valores de Londres, das bases de dados Bloomberg e do Office for National Statistics. Os dados foram submetidos a modelos de defasagens distribuídas autorregressivas (ARDL) e teste de causalidade de Granger. O estudo encontrou uma relação positiva entre o produto interno bruto (PIB) e o retorno das ações. Foi revelado que a inflação tem uma relação negativa com o retorno das ações com valor de coeficiente de 0,621885 a um nível de confiança de 5%. Além disso, o estudo revelou uma relação inversa entre as taxas de juros e os retornos das ações com valor de coeficiente de -0,659179 com nível de confiança de 5%. Por fim, o estudo revelou relação positiva entre o investimento estrangeiro em carteira e o retorno das ações com valor de coeficiente de 1,006504 a um nível de confiança de 5%. O estudo concluiu que as variáveis macroeconómicas afectam os retornos das acções da LSE. O estudo recomenda, portanto, que o governo administre as variáveis macroeconómicas de forma a melhorar o desempenho do mercado de ações.

Palavras-chave: Variáveis Macroeconômicas; Retornos de ações; Bolsa de Valores de Londres

1. Introduction

The importance of a sound stock market on economic efficiency and transfer of resources from idle sectors of the economy to growing sectors cannot be overemphasized. Stock market increases a country’s resilience and boosts growth of the economy. Sahay, et al., (2015) opined that financial market helps enhancing savings, sharing of information, allocation of financial resources, and enables diversification, managing of risk as well as careful lending and monitoring (Ewetan & Ike, 2014). The stock market is essential for producing significant profits and act as a beneficial instrument for investors, individuals, and the government, so contributing to the overall economic expansion and progress of the nation (Valev, 2023). Economists have mostly focused on the allocation of resources to promote the advancement and progress of a nation. The growth rate of the economy is often impeded when there is a lack of allocation of capital resources to crucial economic sectors, particularly those that experience a steady increase in demand. These sectors possess the capacity to augment efficiency, amplify output, and broaden the market for commodities and services (Remi, 2021). The stock market assumes a substantial role in facilitating economic progress through the provision of various services, both overt and covert. However, market has been fluctuating in recent years because of the economic situations of both developed and developing nations therefore investors must be updated with information in the market which will help them to appraise both the risk and returns of the market so has to hedge against the short-term ups and downs of market’s performance.

The happenings around economic fundamentals and returns of stocks in developed markets like London Stock Exchange has continued to receive mixed results. Agwu and Haydar (2023) and Al-Kandari and Abul (2019) reported that macroeconomic factors, such as economic output, unemployment and employment rates, and inflation, are crucial factors of stock returns. Catalano and Rathburn (2023) opined that macroeconomics factors affect the entire economy, including stock price levels, inflation, fluctuations in unemployment, the production growth and income level of a nation. It was reported that variations in macroeconomic settings influences the stocks price and its returns.

Arbitrage pricing theory assumes the establishment of existing connection between macroeconomic indicators and returns of stock markets. It is expected that inflation when is on the high side, investors channeled their financial resources to real assets. This hypothesis thereby opined that equity is a hedge from inflation for the fact that it serves as returns on real assets, depicting a positive stock price should have a correlation with expected inflation” (Al-Khazali, 2004). However, Malika (2023) reported that stock prices and inflation has no relationship. Izedonmi and Abdullahi (2011) in their study also reported no significant effect of inflation as well as exchange rate on market returns. It is against the mixed reports that necessitated the need for the study. The next section considers the literature review followed by methodology after which data was analyzed and interpreted. Finally, the conclusion and recommendations were presented.

2. Literature Review

2.1 Capital Assets Pricing Model (CAPM)

Sharpe (1964), Treynor (1962), Lintner in 1965, as well as Mossin (1966) introduced CAPM as the model for risk and return. It is now the most significant model used to explain how risk and return interact in asset pricing. Black et al.’s (1972) and Fama and Macbeth’s (1973) works both praised this.

The foundation of CAPM involves the creation of an effective market portfolio that, at a given risk level, maximises return. The risk covariance of a certain securities with the market determines its predicted return. According to the concept, premium on taking a risk is depicted by the stock’s beta coefficient—an indicative of how sensitive it is to market movement overall—determine the projected return on an investment. Equation (2) allows the CAPM to be expressed as;

This represents the connection with expected return on the stock E(Ri), a riskless rate of return (Rf), the expected market return (Rm), as well as beta coefficient (β), that measures the stock's responsiveness to market movements. The volatility is measured by it. Beta was the sole explanatory factor that could explain the cross-sectional adjustment on stock portfolios, and earlier analytical testing of the model usually agrees with its primary predictions.

More recently, however, a variety of factors, other than the market risk variable, have been found in empirical research on asset pricing to assist explain cross-sectional variance in stock returns. In theory, Roll (1977) contended, the market portfolio should comprise all assets that people own as investments, such as artwork, human capital, etc. Practically, the market portfolio does not directly visible, and oftentimes stock indexes are used as a stand-in for the actual market portfolio. Nevertheless, research has revealed that this change is not harmless and may cause people to draw incorrect conclusions about the CAPM’s validity. According to some, the genuine market portfolio is unobservable, which makes the CAPM potentially untestable experimentally. Roll is credited with this critique.

2.2 Efficient Market Hypothesis [EMH]

In 1970, Eugene Fama introduced the concept of an efficient market, which he described as one in which prices consistently represent all accessible data. According to Fama and Malkiel (1970), this implies that fresh knowledge is what drives price changes in a market. Semi-strong form, weak form as well as Strong form entails three distinct forms of EMH that are specified in the majority of academic financial literature. What constitutes “available information” differs in various forms (Mankiw & Taylor, 2017).

According to the weak form, technical analysis cannot provide investors with a competitive advantage in the market since stock prices are said to represent all past price data. The semi-strong form implies that stock prices are a reflection of all available information, including past price data. Consequently, investors are unable to employ technical or fundamental analysis because all of this information has already been “priced in.” Similar to the semi-strong form, the ultimate version of the EMH is also known as the strong form, and it incorporates the additional feature that any non-public information, such as insider knowledge, is fully taken into consideration when valuing stocks (Mankiw & Taylor, 2017).

Semi-strong form assumes that stock prices completely reflect all economic factors, this form is therefore well-suited for considering the connection between macroeconomic fundamentals and returns of stock. Therefore, APT, CAPM and EMH have importance in studying the relationship stock prices have with macroeconomic fundamentals, since it implies asset’s price and returns is sensitive to some particular macroeconomic indicators.

2.3 The Classical Theory of Interest Rate

Interest rates are based on supply and demand for capital, according to this classical economic theory. Anokwuru (2017) cites classical economists' hypothesis that the supply and demand for capital (saves) influence interest rates, with the assumption that the supply of savings or investment is inversely connected to the interest rate. Earnings from safe, manageable loans constitute the interest rate.

Even if there were different takes on what drives savings demand and supply, one thing that all classical authors agreed on was that saves are interest-elastic. Interest rates have been characterised in different ways by different authors; some see them as a reward for savers who forego spending their full income, while others see them as a fee for borrowers who value immediate gratification. This was deemed an interesting and genuine theory by the classical economics. Because interest rates are completely independent of monetary policy, this is the case. According to traditional economists, savings and the supply of capital are synonymous. People cut back on their consumption expenditures to free up capital. It was therefore believed that the interest rate was the determining factor in savings, loans and investment. The investment timetable, they said, falls downward. Investors (business firms) will opt to invest more at a lower interest rate. It is affected by the interplay between savings and investment. With full employment assumed, there is no relationship between income levels and the equilibrating mechanism of an interest rate that exists when savings and investment are equal (Inimino, Abuo & Bosco, 2018).

Macroeconomic variables and its effect on stock returns have grossly been examined but results were contradictory. Kuwornu (2012) documented positive connection between inflation, exchange rate and interest rate were found to negatively influence market returns. Similarly, Emenike and Odili (2014) found negative connection between inflation, money supply and market returns. Gunasekarage et al., (2014) considered macroeconomic fundamentals and returns of stock in emerging markets. Result revealed that lagged value of money supply, interest rate and consumer price index significantly impact stock market. While, interest rate has strongest impact on stock price movement than other variables. Lwin, Hui and Hla (2023) looked at macroeconomic indicators and Indonesia stock market composite index (IDX). Inflation and interest rate are found to granger cause IDX. The study assumes that macroeconomic indicators is sacrosanct in explaining the performance and fluctuation of the IDX.

Okoebor (2022) employed OLS, and it was shown that banks’ credit, exchange rate as well as interest rate negatively affect returns on market. Khalid and Khan (2017) showed exchange rate as well as inflation to be positively affect stock market index in Pakistan. In Nigeria, Kolapo (2018) revealed an existence of long run connection of macroeconomic indications on performance of stock market. Winful (2016) posited money supply insignificantly influence performance of stock market. Ibrahim and Aziz (2003) established short and long run connection between macroeconomic indicators and prices of stock as well as stock market causally influence macroeconomic variables prediction.

Masuduzzaman (2012) researched macroeconomic indicators and market returns in Germany and United Kingdom. It was revealed that, at short period interval most of the forecast horizons of the movement in stock price are being determined by the stock price in both Germany and United Kingdom. However, for long-term horizons money supply as well industrial production index explain the variance in stock price movements for Germany while in United Kingdom, industrial production index and exchange rate explain variance in stock movement. In Turkey, Kandir (2008) investigated macroeconomic indicators and Turkish’s stock return. Using multiple linear regression, interest rate, exchange rate and world market index were found to affect portfolio returns. Menike, Dunusinghe and Ranasinghe (2015) found inflation, GDP and exchange rate important in predicting stock market returns in London Stock Exchange and Colombo Stock Exchange while unemployment and foreign direct investment are significant only in Colombo Stock Exchange.

Singh, Mehtar and Varsha (2010) study was based on portfolio of stocks using price to earnings ratio, portfolio construction, yield and price to book value ratio. The portfolio constructed was three and they were ranked according to construction criteria. GDP and exchange rate were seen to have great impact on companies listed in Taiwan 50 index. Findings of Barakat, Elgazzar and Hanafy (2015) revealed bidirectional connection of money supply, exchange rate and stock market return while unidirectional causal effect was observed between interest rate, consumer price index and stock market return in Egypt.

Agwu and Haydar (2023) showed that interest rate appeared to be most significant factor that influences London stock market. However, consumer price index has less significance influence compared to interest rate and exchange rate on stock market. Musa et al (2024) employed regression analysis in their study and indicated that inflation and exchange rate negatively but significantly influence the market returns. Bui and Nguyen (2021) considered macroeconomic indicators and bank stock returns in Vietnam. The outcome shows that growth of industrial production index and bank stocks impact the stock return of Vietnamese banks significantly with probability of 1 and 0.9 respectively. The study shows other macroeconomic factors utilized in the study have no impact on Vietnamese banks stocks.

Abdo (2021) found macroeconomic indicators to have a huge impact on Amman stock exchange. The outcome revealed further that macroeconomic indicators have direct and indirect effect on stock returns. Inflation and interest rate were observed inversely influence stock returns. Kitati, Zablon and Maithya (2015) concluded that when interest rate increases the stock market indices lose points and lower stock market indices is associated with higher levels off inflation in Kenya. Findings from Anayochukwu (2012) revealed that foreign portfolio investment significantly and positively influence stock market returns while Inflation insignificantly impact stock market returns in Nigeria.

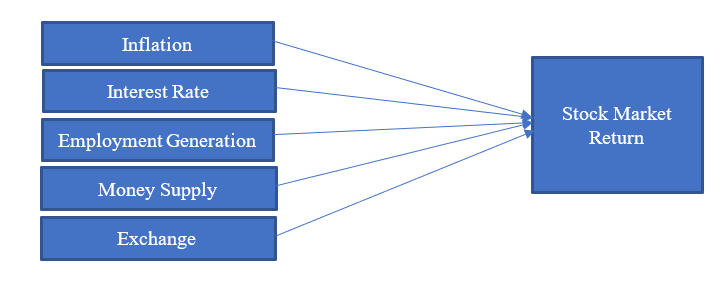

2.4 Conceptual Framework

Source: Author’s Construction (2024).

The connection between variables that are independent and dependent is depicted in the conceptual framework. The dependent variable that is being measured or observed in this study is the stock market return, whereas the independent variables are the interest rate, inflation, employment generation, money supply and exchange rate.

3. Methodology

Expost-Facto research design was adopted for the study and it was due to the fact that the researcher refrained from interfering with the fact of the study as well as because the investigation commenced after the establishment of the fact of the study and this is because all of the necessary data was already available. The London Stock Exchange and Bloomberg databases provided the data which is secondary in nature and covers the years 2006–2023. The Office for National Statistics, Bank of England, HM Treasury, Eurostat, and Trading Economics databases were consulted for the macroeconomic variables. The study's estimation method relied on the characteristics of the data collected. In order to accomplish its goals, the study utilised an autoregressive distributed lags model (ARDL) and Granger Causality Tests. ARDL model is suitable when the variables are cointegrated at orders I(0) and I(1). According to this method, the long-term connection of the series is regarded solidified when the F-statistic crosses over the critical value band. The fact that it can locate the cointegrating vectors in the presence of many them is the method's primary strength. The estimating process included conducting a number of tests.

The explanatory power of the independent variable or the goodness of fit of the regression line to sample observations was tested using the coefficient of determination, R2. Furthermore, the overall significance of the regression model was tested using the F-test. To determine the precise level of statistical significance of the coefficients, the T-test approach is employed. These are established by econometric theory and seek to probe the extent to which the assumptions of the econometric approach used are met.

3.1 Model Specification

4. Results and Discussion

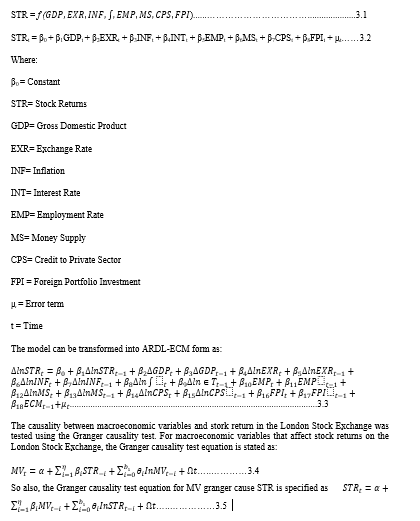

Table 4.1: ADF Unit Root Test Results

Source: Authors computation (2024)

Time series data often exhibits patterns and typically lacks stability. Using OLS when analysing the connection of a nonstationary variables on another nonstationary variable which might lead to erroneous regression results. The results obtained from the ADF test indicate that GDP, INF, EMP, and FPI demonstrate stationarity at the level, whereas STR, EXR, INT, MS, and CPS exhibit integration of order one (I(1)) rather than zero. Hence, it is crucial to do an ARDL Bound Test to determine the cointegration of the variables by examining the combination of I(0) and I(1) stationarity.

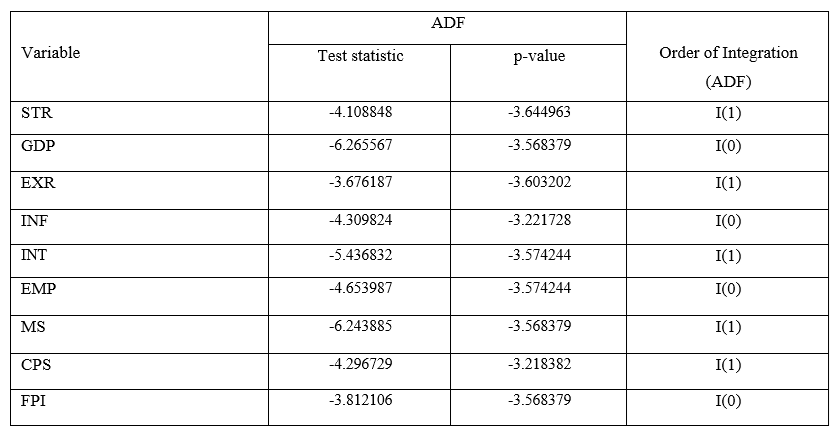

Table 4.2: ARDL Bound Test for Stock Returns

Source: Author’s Computation, 2024

The results of Table 4.2 revealed a bound test F-statistics of 5.524207 had a higher value compared to the value of upper bound of 3.71 at a significance level of 5%. The aforementioned observation identifies the presence of an enduring associations among the variables. Therefore, this result facilitated the advancement to ARDL model estimate.

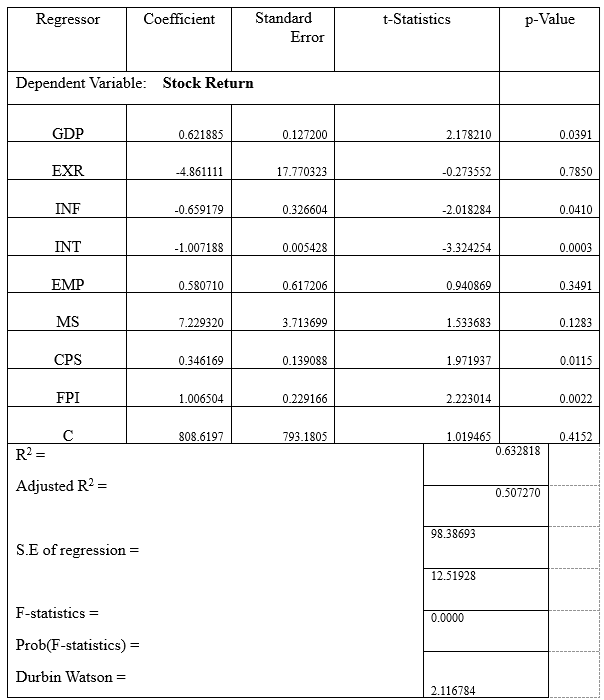

Table 4.3: Estimated Long-run Coefficients Based on ARDL for Stock Return

Source: Author’s Computation, 2024

The data presented in Table 4.3, the R-squared value is 0.632818, suggesting a substantial degree of adequacy in the model's fit. The data suggest that the GDP, exchange rate, inflation, interest rate, money supply, employment rate, credit to private sector, foreign portfolio investment collectively explained 63.2% of the observed fluctuations in stock return. The revealed F-statistic of 12.51928, associated with p-value of 0.0000, provides evidence supporting the reliability of the model. The findings indicate that the model exhibits a fair degree of adequacy and reliability in producing accurate predictions.

The gross domestic product coefficient, as presented in Table 4.3, is 0.621885, accompanied p-value of 0.0391. The results depicted a direct linkage of GDP and stock returns. Likewise, credit to private sector and foreign portfolio investment exhibit a favourable and statistically significant impact on stock return, as depicted with coefficient of 0.346169 and 1.006504 and p-values of 0.0115 and 0.0022 respectively. Therefore, an increase in GDP, CPS as well as foreign portfolio investment will lead to 0.621885, 0.0115 and 0.0022 increase in stock return respectively. However, inflation as well as interest rate exhibit a indirect but significant impact on stock return, as evidenced by coefficient of -0.659179 and -1.007188 as well as p-values of 0.0410 and 0.0003 respectively. The statistical analysis revealed that macroeconomic variables impact on London Exchange stock returns.

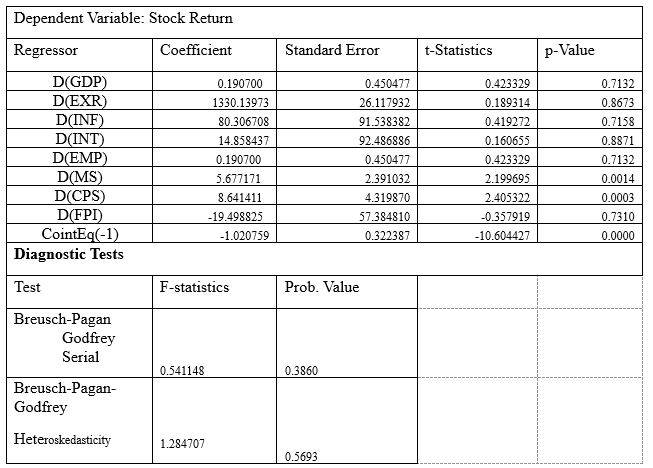

Table 4.4: Short run Results and Diagnostics Tests results

Source: Author’s Computation, 2024

Table 4.4 above depicted the outcomes of the model's short-term dynamics. The long-term connections among variables of the model is provided by the significant but negative estimate of CointEq(-1). The results also indicate that the estimated value of CointEq(-1) is -1.020759, which significantly affect at a 1 percent significance level. The results of the test presented suggested no evidence of serial correlations. Furthermore, no evidence of mis-specification error is seen. In addition, the Breusch-Pagan heteroskedasticity statistics of 1.284707, along with p-values of 0.5693, suggest that there is no evidence of heteroskedasticity in the models. Based on the absence of statistical significance in the statistical analysis and the inability to reject the null hypothesis of equal variance in the test, this conclusion can be inferred.

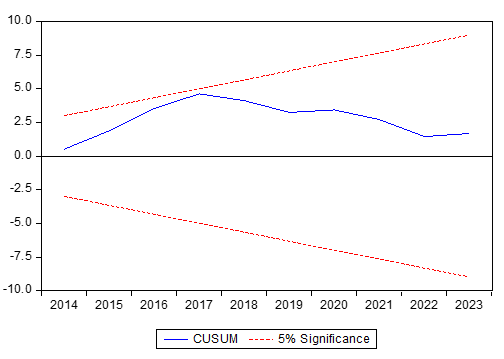

Fig 4.1: CUSUM Tests

4.1 Stability Tests

The inquiry continued with tests to evaluate the stability of long-term coefficients using cumulative sum of residuals (CUSUM) tests. It is imperative that the CUSUM value remains inside the two crucial lines in order to ensure stability at 5% significance level. However, when the lines fall outside these lines then there exists an instability of the model. The data illustrates that the CUSUM plot is situated within the crucial bounds. Therefore, it can be inferred that the parameters of the model demonstrate stability.

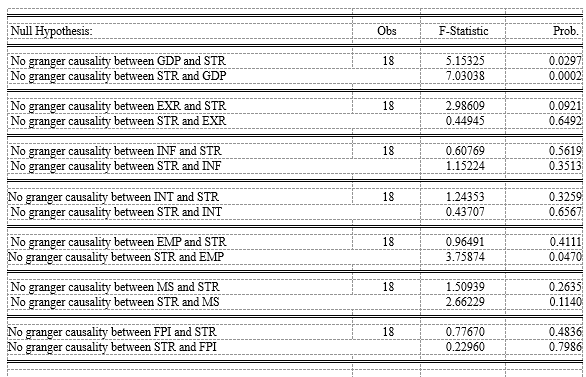

Table 4.5 Granger Causality for Stock Return

Source: Author’s Computation, 2024

The Granger causality test was employed for this study. GDP has bi-directional causality with stock return was obtained while uni-causality existed between GDP and inflation. It was also reported that one-way causal relationship existed between stock returns and employment rate. Therefore, it may be inferred existence causality with macroeconomic variables and stock return of London Stock Exchange.

4.2 Discussion of Findings

Autoregressive lag model (ARDL) was considered to analyse macroeconomic fundamentals and stock returns. The outcomes revealed a significant impact between GDP and stock return. The findings presented here are consistent with prior studies undertaken by Hsing and Hsieh (2012), Agwu and Haydar (2023), and Piero (2016), which also highlight the importance of gross domestic product in influencing stock returns. The study's findings additionally demonstrated an inverse effect of inflation on stock performance. The findings of Sampath (2011) and Abed and Zardoub (2019) are consistent with these results which suggests that there exists no correlation between inflation and the stock return of the London Stock Exchange. According to the eclectic hypothesis, enterprises must effectively manage inflation in a country to attract capital. This will encourage foreign investors to the country.

The findings of Honig (2019) and Jareno, Escribano, and Celebi (2019) align with the notion that there exists a noteworthy correlation between CPS and stock returns. Hence, it is appropriate to reject the null hypothesis that posits an insignificant link between CPS and stock returns. The analysis additionally shows foreign portfolios influence stock returns is substantial, aligning with the findings of Abed and Zardoub (2019) as well as Jareno, Escribano, and Celebi (2019). According to the theory of flexible accelerator hypothesis and classical economic theory, this study aligns with. These theories propose that macroeconomic variables influence the supply and demand for capital. They postulate that the supply of savings or investment is inversely correlated with the interest rate and positively correlated with gross domestic product.

5. Conclusion and Recommendations

The stock market plays various crucial functions, such as facilitating the movement of funds, creating liquidity, mitigating risk through diversification, enhancing the flow and acquisition of information, and reinforcing the motivation for corporate governance. The study therefore concludes that gross domestic product affects stock returns of LSE. It was also concluded that inflation influence stock returns of LSE. The study further concludes that inflation impacts stock returns of LSE. Finally, the study concluded that macroeconomic variables affect stock returns of LSE. The study therefore recommends that government should manage the interest rate in such a way that will improve the performance of stock market. Government and statutory capital market authorities should implement policies that enhances the accessibility of the London financial market and economy to further capital inflows, which are necessary for the advancement of economic and industrial growth. Investors are recommended to mitigate the impact of stock price volatility by establishing portfolios that are widely diversified and mirror the total market portfolio. Active rational investors may analyse gross domestic product (GDP) as a means to optimise investment returns in both the short and long term, as its impact is positive and statistically significant in both time periods.

References

Abdo, K. K., Al-Qudahb, A. M., Al-Qudah, A. L., & Qudah, M. Z. (2021). The effect of economic variables (workers ‘diaries abroad, bank deposits, gross domestic product, and inflation) on stock returns in the Amman Financial Market from 2005/2018. Journal of Sustainable Finance & Investment. 1-14. https://doi.org/10.1080/20430795.2021.1883384

Abed, R. E. & Zardoub, A. (2019). Exploring the nexus between macroeconomic variables and stock market returns in Germany: An ARDL Co-integration approach. Theoretical and Applied Economics, 2(2), 139-148.

Acha, I. A., & Acha, C. K. (2011). Interest Rates in Nigeria: An Analytical Perspective. SSRN Electronic Journal.

Adegboyo, O. S., Keji, S. A., & Fasina, O. T. (2021). The impact of government policies on Nigeria economic growth (case of fiscal, monetary and trade policies). Future Business Journal, 7(1).

Agwu, M. O. & Haydar, A. H. (2023). Impact of Macroeconomic Factors on Stock Market in the London Stock Exchange, Frontiers in Management Science, 2(2), 1-12.

Ajuwon, O. S., Ikhide, S., & Akotey, J. O. (2017). Msmes and Employment Generation in Nigeria. The Journal of Developing Areas, 51(3), 229–249.

Al-Kandari, A. M. & Abul, A. J. (2019). The Impact of Macroeconomic Variables on Stock Prices in Kuwait. International Journal of Business and Management, 14(6), pp. 99- 112.

Alam, Z., & Rashid, K. (2014). Time Series Analysis of the Relationship between Macroeconomic Factors and the Stock Market Returns in Pakistan. Journal of Yasar University, 9(36), 6261 – 6380.

Ali, B. M. (2023). Co integrating relation between macroeconomic variables and stock return: Evidence from Dhaka Stock Exchange (DSE). International Journal of Engineering, Economic, Social Politic and Government, 1(1), 1-14.

Amtiran, P., Indiastuti, R., Nidar, S. & Masyita, D. (2017). Macroeconomic factors and stock returns in APT framework. International Journal of Economics and Management, 11, 197-206.

Anayochukwu, O. B. (2012). The Impact of Stock Market Returns on Foreign Portfolio Investment in Nigeria. IOSR Journal of Business and Management, 2(4), 10-19,

Arikpo, O. F., Udoka, C. O., & Bassey, I. I. (2015, August 25). Interest Rate: A Key Variable In Deposit Money Banks’ Lending Behaviour In Nigeria. Archives of Business Research, 3(4).

Ayhan, F., & Elal, O. (2023, May). The IMPACTS of technological change on employment: Evidence from OECD countries with panel data analysis. Technological Forecasting and Social Change, 190, 122439.

Barnor, C. (2014). The Effect of financial indicators on stock market returns in Ghana (2000- 2013). Retrieved online from: http://scholarworks.waldenu.edu/dissertations/l32/

Barakat, M., Elgazzar, S. & Hanafy, K. (2018). Impact of Macroeconomic Variables on Stock Markets: Evidence from Emerging Markets. International Journal of Economics and Finance, 10(8), 195-207.

Bernanke, B., Laubach, T., Mishkin, F. S., & Posen, A. (2018, June 5). Inflation Targeting: Lessons from the International Experience. ResearchGate; unknown. https://www.researchgate.net/publication/326216536_Inflation_Targeting_Lessons_from_the_International_Experience

Black, F., Jensen M. C. & Scholes M. (1972). The Capital Asset Pricing Model: Some Empirical Tests in Studies in the Theory of Capital Markets. Michael C. Jensen, ed. New York: Praeger, 79–121.

Blanchard, O. (2017). Macroeconomics (Ed. 7). England: Pearson.

Bordo, M. D. & Levin, A. T. (2017). Central Bank Digital Currency and the Future of Monetary Policy. NBER Working Papers 23711, National Bureau of Economic Research, Inc.

Brahmasrene, T. & Jiranyakul, K. (2007). Cointegration and causality between. stock. index and macroeconomic variables in an emerging market. Academy of Accounting and Financial Studies Journal, 11(3), 17-30.

Bui, M. T., Nguyen, T. T. (2021). Impact of macroeconomic factors on bank stock returns in Vietnam. Data Science for Financial Econometrics, 898(1), 493-511.

Celebi, K. & Hong, M. (2019). The impact of Macroeconomic Factors on the German Stock Market: Evidence for the Crisis, Pre- and Post-Crisis Periods. International Journal of Financial Studies, 7(18).

Chauque, D. F. F. & Rayappan, P. A. (2018). The Impact of Macroeconomic Variables on Stock Market Performance: A Case of Malaysia. Edelweiss Applied Science and Technology, 100–104.

Ditimi, A., & Ifeoluwa, B. (2018). A Time Series Analysis of the Nexus Between Macroeconomic Fundamentals and Stock Prices in Nigeria. Studies in Business and Economics, 13(2), 69–91. https://doi.org/10.2478/sbe-2018-0021

Epaphra, M. & Salema, E. (2018). The impact of macroeconomic variables on stock prices in Tanzania. Journal of Economics Library, 5(1), 12-41.

Ernest, W. C., Jnr, S. D. & Kofi, S. A. (2016). Macroeconomic variables and stock market performance of emerging countries. Journal of Economics and International Finance, 8(7), 106-126.

Emenike, K. O. (2016). Comparative analysis of bureaux de change and official exchange rates volatility in Nigeria. Elsevier Intellectual Economics, 10(1), 28-37.

Ewetan, O. O. & Ike, D. N. (2014) Does Financial Sector Development Promote Industrialization in Nigeria? International Journal of Research in Social Sciences, 4(1): 17-25.

Fama, E. F. (1981). Stock Returns, Real Activity, Inflation and Money. American Economic Review, 71(4), 545−565.

Friedman, M. (1956). The Quantity Theory of Money—A Restatement. In: Studies in the Quantity Theory of Money. University of Chicago Press, Chicago, 3-21.

Forson, J. A. & Janrattanagul, J. (2013). Selected Macroeconomic Variables and Stock. Market Movements: Empirical evidence from Thailand. Contemporary Economics, 8(2), 157-174.

Giri, A. K. & Joshi, P. (2017). The Impact of Macroeconomic Indicators on Indian Stock Market Prices: An Empirical Analysis. Studies in Business and Economics, 12(1), 61-78.

Gopinathan, R. & Durai, S. R. S. (2019). Stock market and macroeconomic variables: new evidence from India. Financial Innovation, 5(29).

Gunasekarage, A., Pisedtasalasai, A., & Power, M. D. (2014). macro-economic influences on the stock market: Evidence from an emerging market in South Asia. Unpublished manuscript.

Gurloveleen, K. & Bhatia, B. S. (2015). An Impact of Macroeconomic Variables on the functioning of Indian Stock Market: A Study of Manufacturing Firm of BSE 500. Journal of Stock & Forex Trading, 5(1).

Ibrahim M.H. & Aziz H., (2003), “Macroeconomic Variables and the Malaysian Equity Market: A View through Rolling Subsamples”, Journal of Economic Studies, Vol. 30, pp. 6-27.

Kandir, Y. S. (2008). Macroeconomic variables, firm characteristics and stock returns: Evidence from Turkey. International Research Journal of Finance and Economics, 16(1), 35-45.

Khalid, W., & Khan, S. (2017). Effects of macroeconomic variables on the stock market volatility: The Pakistan Experience. International Journal of Econometrics and Financial management, 5(2), 42-59. https://doi.org/10.12691/ijefm-5-2-4

Kirui, E., Wawire, H.W. & Onono, P.O. (2014). Macroeconomic Variables, Volatility and Stock Returns: A Case of Nairobi Securities Exchange, Kenya. International of Economics and Finance, 6(8).

Kitati, E., Zablon, E., & Maithya, H. (2015). Effect of macro-economic variables on stock market prices for the companies quoted on the Nairobi securities exchange in Kenya. International Journal of Sciences: Basic and Applied Research, 21(3), 235-263.

Kolapo, F. T., Oke, M. O., & Olaniyan, T. O. (2018). Unravelling the impact of macroeconomic Fundamentals on stock market performance in Nigeria: An ARDL bound testing approach. Journal of Economics, Management and Trade, 21(3), 1-15.

Kowornu, J.K. (2012). Effect of macroeconomic variables on the Ghanaian Stock Market returns: A Co-integration analysis. Research in Agricultural & Applied Economics, 4(2), 1-12.

Kuwornu, J. K. M. (2012), Effect of Macroeconomic Variables on the Ghanaian Stock Market Returns: A Co-integration Analysis. Agris on-line papers in Economics and informatics, 4(2).

Hanushek, E. A., & Woessmann, L. (2012). Do better schools lead to more growth? Cognitive skills, economic outcomes, and causation. Journal of Economic Growth, 17(4), 267-321.

Hashim, S. L. M., Ramlan, H. & Rosly, M. A. M. (2018). The Impact of. Macroeconomic Variables towards Malaysian Stock Market. Global Business and Management Research: An International Journal, 10(3), 315-327.

Hsing, Y. & Hsieh, W. (2012). Impacts of macroeconomic variables on the stock market index in Poland: new evidence. Journal of business economics and management, 13(2), pp.334–343.

Hunjra, A. I., Chani, M. I., Shahzad, M., Farooq, M. and Khan, K. (2014). The Impact of Macroeconomic Variables on Stock Prices in Pakistan. International Journal of Economics and Empirical Research, 2(1), 13-21.

Ilahi, I., Ali, M., & Jamil, R. A. (2015). Impact of Macroeconomic Variables on Stock Market Returns: A Case of Karachi Stock Exchange. SSRN Electronic Journal. https://doi.org/10.2139/ssrn.2583401

Izedonmi, P. F. & Abdullahi, I B. (2011). The Effects of Macroeconomic Factors on the Nigerian Stock Returns: A Sectoral Approach. Global Journal of Management and Business Research, 11(7), 25-30.

Jareno, F., Escribano, A. & Cuenca, A. (2019). Macroeconomic Variables and Stock Markets: An International Study. Applied Econometric and International Development, Euro-American Association of Economic Development, 19(1), 43-54

Kabir, S. H., Bashar, O. K. M. R. & Masih, A. M. M. (2014). Is Domestic Stock Price. Cointegrated with Exchange Rate and Foreign Stock Price: Evidence from Malaysia. The Journal of Developing Areas, 48(3), 285-302.

Kalra, R. (2012). Impact of Macroeconomic Variables on Indian Stock Market. The IUP Journal of Financial Risk Management, 9(1), 43-54.

Kelikume, I. (2016). The effect of budget deficit on interest rates in the countries of sub-Saharan Africa: A panel VAR approach. The Journal of Developing Areas, 50(6), 105–120.

Keswani, S. & Wadhwa, B. (2019). Evaluating the Impact of Macroeconomic Variable on Indian Stock Market. International Journal of Engineering and Advanced Technology, 8(6), 4427-4434.

Keynes, J.M. (1936). The General Theory of Employment, Interest and Money. Palgrave Macmillan, London.

Khan, J. & Khan, I. (2018). The impact of macroeconomic variables on stock prices: A case study Of Karachi Stock Exchange. Journal of Economics and Sustainable Development, 9(13),15-25.

Khan, M. M. & Yousuf, A. S. (2013). Macroeconomic Forces and Stock Prices: Evidence from the Bangladesh Stock Market. MPRA Paper 46528, University Library of Munich, Germany.

Khan, M. N. and Zaman, S. (2012). Impact of Macroeconomic Variables on Stock Prices: Empirical Evidence from Karachi Stock Exchange, Pakistan. Business, Economics, Financial Sciences, and Management, 143, 227-233.

Khatri, D. K. (2024). Analysing the Impact of Major Financial Crisis on Macroeconomic Variables and Stock Prices: An Empirical Study of Stock Market of United Kingdom. Asian Journal of Economics, Business and Accounting, 24(5), 412-432.

Khodaparasti, R.B. (2014). The Role of Macroeconomic Variables in The Stock Market In Iran. Polish Journal of Management Studies, 10(2), 54-64.

Kuwornu, J. K. M. (2011). Macroeconomic Variables and Stock Market Returns: Full Information Maximum Likelihood Estimation. Research Journal of Finance and Accounting, 2(4), 49-63.

Limpanithiwat, K., Rungsombudpornkul, L. (2010). Relationship between Inflation and Stock Prices in Thailand. Master Thesis in Finance, Umea School of Business, UMEA University, Sweden, 1-60.

Lwin, S. A., Hui, K. J., & Hla, T. D. (2023). Analysis of macroeconomic indicators and IDX composite index: Evidence from Indonesia. International Journal of Academic Research in Business and Social Sciences, 13(9), 1225-1238.

Masuduzzaman, M., (2012). Impact of the macroeconomic variables on the stock market returns: The case of Germany and the United Kingdom. Global Journal of Management and Business Research, 12(16), 15-26.

Md. F. H. K. & Md. M. B., (2023). "Macroeconomic factors and Stock exchange return: A Statistical Analysis," Papers, 2305.02229.

Mankiw, N. G. (2017). Supplement: Principles of Economics 8th edition. Singapore: Cengage

Mankiw, N.G. & Taylor M.P. (2017). Economics. Fourth edition. Hampshire: Annabel Ainscow.

Marshall, R. J. &Vasilev, A. (2022). Impact of Macroeconomic Variables on the Stock Prices of London Stock Exchange FTSE 100, IUP Journal of Financial Risk Management, 19(2), 52-86.

Maysami, R. C., Howe, L. C. & Hamzah, M. A. (2004). Relationship between Macroeconomic Variables and Stock Market Indices: Cointegration Evidence from Stock Exchange of Singapore’s All-S Sector Indices. Jurnal Pegurusan, 24, 47-77.

Menike, L. M., Dunusinghe, P. M., & Ranasingh, A. (2015). Macroeconomic and firm specific determinants of stock returns: A comparative analysis of stock markets in Sri Lanka and in the United Kingdom. Journal of Finance and Accounting, 3(4), 86-96.

Mishkin, F.S. (2016). The Economics of Money, Banking, and Financial Markets. 11th Edition, Pearson, Harlow.

Mohan, R., & Kapur, M. (2014). Monetary Policy Coordination and the Role of Central Banks. IMF Working Papers, 14(70), 1.

Mossin, J, (1966). Equilibrium in a Capital asset Market. Econometrica, 34(4), 768 – 783.

Mwangi, M., & Mwiti, J.K. (2015). The effect of voluntary disclosure on stock market returns of companies listed at the Nairobi securities exchange. International journal of business and social science, 6.

Mugambi, M. & Okech, T. C. (2016). Effect Of Macroeconomic Variables On Stock Returns Of Listed Commercial Banks In Kenya. International Journal of Economics, Commerce and Management, 4(6), 390-418.

Musa, W. F., Faizal, Z. M., Rahman, I. N., Norzamri, L. N., & Jailani, S. A. (2024). The effect of exchange rate, inflation rate, and gross domestic product on Malaysia stock market return. Global Business and Management Research: An International Journal, 16(2), 1188-1198.

Ogiemudia, O., Osifo, O. & Eghosa, I. (2022). Market Risk Factors and Stock Returns in the Nigerian Bourse, CBN Journal of Applied Statistics, 13(2), 79-115.

Okoebor, E. S. (2022). Effects of macroeconomic variables on stock market performance in Nigeria: 1986 – 2020. African Journal of Social and Behavioural Sciences, 12(1), 49-70.

Owusu-Nantwi, V, & John, K. M. K. (2011). Analyzing the effect of macroeconomic variables on stock market returns: Evidence from Ghana. Journal of Economics and International Finance, 3(11), 605-615.

Peiró, A. (2016). Stock prices and macroeconomic factors: Some European evidence. International review of economics & finance, 41, 287–294.

Pilinkus, D., & Boguslauskas, V. (2009). The short-run relationship between stock market prices and macroeconomic variables in Lithuania: An application of the impulse response function. Engineering Economics, 5(65), 26-34.

Rahman, S. & Serletis, A. (2009) The Effect of Inflation Uncertainty, Some International Evidence. Journal of Economic Studies, 36, 541-550.

Roll, R., (1977). A Critique of the Asset Pricing Theory’s Tests’ Part I: On Past and Potential Testability of the Theory. Journal of Financial Economics, 4(2), 129 –176.

Ross, S. A., (1976). The Arbitrage Theory of Capital Asset Pricing. Journal of Economic Theory, 13, 341–360.

Sahay, R., M. Čihák, P. N’Diaye, A. Barajas, R. Bi, D. Ayala, Y. Gao, A. Kyobe, L. Nguyen, C. Saborowski, K. Svirydzenka and S.R. Yousefi (2015) “Rethinking Financial Deepening: Stability and Growth in Emerging Markets”, International Monetary Fund, Staff Discussion Note.

Sampath, T. (2011). Macroeconomic Variables and Stock Prices in India: An Empirical Analysis. IUP Journal of Monetary Economics, 9(4): pp.43-55.

Schumpeter, J. A. (1942). Capitalism, Socialism and Democracy. Harper & Brothers.

Sharpe, W., (1964). Capital Asset Prices: A Theory of Market Equilibrium under conditions of Risk. Journal of Finance, 19, 425 – 442.

Singh, T., Mehta, S., & Varsha M. S. (2011). Macroeconomic factors and stock returns: Evidence from Taiwan. Journal of Economics and International Finance, 2(4), 217-227.

Sirucek, Martin, (2012). Macroeconomic variables and stock market: US review. MPRA Paper 39094, University Library of Munich, Germany.

Treynor, J., (1999). Toward a Theory of Market Value and Risky Assets, Unpublished manuscript, Final version in Asset Pricing and Portfolio Performance. Robert A. Korajczyk, ed., London: Risk Books, 15 – 22.

Uchendu, O. (1993). Interest rate policy savings and investment in Nigeria. Central Bank of Nigeria Quarterly Review. 31(1) 34 - 52.

Violita, C. E. (2019). Stock Liquidity and Stock Return. Ekspektra : Jurnal Bisnis Dan Manajemen, 111–122.

Recebido: 21/10/2024

Aceito: 12/11/2024

------

Notas

[1] University of Ilorin, Nigéria. Email: kolawole.kd@unilorin.edu.ng ORCID: https://orcid.org/0000-0002-6704-2673

[2] University of Winchester, United Kingdom. Email: oluwagbenga.seyingbo@winchester.ac.uk ORCID: https://orcid.org/0000-0003-0540-156X

[3] University of Abuja, Nigéria. Email: bashirat.oloyin-abdulhakeem@uniabuja.edu.ng

[4]Department of Finance, University of Ilorin, Nigeria. Email: haliru.au@unilorin.edu.ng ORCID: https://orcid.org/0009-0008-3151-7500

[5] Department of Banking & Finance, Ekiti State University, Nigeria. Email: ousmanogroup@gmail.com ORCID: https://orcid.org/0009-0000-9588-8935