Financial inclusion and inflation in Nigeria

INCLUSÃO FINANCEIRA E INFLAÇÃO NA NIGÉRIA

Emmanuel Oyasor [1]

DOI: 10.23925/2446-9513.2025v12id70279

ABSTRACT

This study examined the impact of financial inclusion on inflation in Nigeria. Secondary Data were obtained from Central Bank of Nigeria statistical bulletin from 1993 to 2022. The study employed Auto Regressive Distributed Lag to analyze the data obtained. The study found that credit to small and medium scale, currency in circulation, deposits of rural branches of commercial banks and number of registered mobile money account have impact on inflation in Nigeria. The study concluded that financial inclusion influences inflation in Nigeria. The study recommends that financial institutions, especially commercial banks in Nigeria, expand their loans to the small and medium scale enterprises for more profitable investments in light of the results and conclusions derived from them. This will improve domestic investment, expand the size of the financial sector's expansion, and increase access to investible money. Finally, monetary authorities in Nigeria should put measures in place to always ensure financial inclusiveness. This will go a long way in reducing uncertainty regarding investment opportunities and encourage investors to put their funds in the local markets.

Keywords: Financial inclusion, Inflation, ARDL

RESUMO

Este estudo examinou o impacto da inclusão financeira na inflação na Nigéria. Os dados secundários foram obtidos do Banco Central da Nigéria Boletim estatístico de 1993 a 2022. O estudo empregou Atraso Distribuído Autorregressivo (ARDL) para analisar os dados obtidos. O estudo constatou que o crédito a pequena e média escala, moeda em circulação, depósitos de agências rurais de bancos comerciais e número de conta de dinheiro móvel registrado têm impacto na inflação na Nigéria. O estudo concluiu que a inclusão financeira influencia a inflação na Nigéria. O estudo recomenda que as instituições financeiras, especialmente os bancos comerciais na Nigéria, expandam seus empréstimos para as pequenas e médias empresas para investimentos mais lucrativos, à luz dos resultados e conclusões derivadas deles. Isso melhorará o investimento doméstico, expandirá o tamanho da expansão do setor financeiro e aumentará o acesso ao dinheiro investido. Finalmente, as autoridades monetárias da Nigéria devem implementar medidas para garantir sempre a inclusão financeira. Isso ajudará bastante a reduzir a incerteza em relação às oportunidades de investimento e incentivará os investidores a colocar seus fundos nos mercados locais.

Palavras-chave: Inclusão financeira, inflação, ARDL

1. Introduction

In recent years, inflation has become a significant global issue that exacerbated by unexpected macroeconomic events like the COVID-19 pandemic, geopolitical conflicts, and other destabilizing factors. These disruptions have far exceeded the expectations of policymakers in many nations. According to the World Bank Group (2023), the recent surge in inflation, particularly from 2020 to 2022, was primarily driven by oil price volatility and global demand shocks, which together accounted for 65% of total inflation variations (Ha et al., 2023). This figure marks a significant increase compared to the 56% variation attributed to similar factors between 1970 and 2000 (The Global Findex Database, 2021). The impact of these inflationary pressures has been profound, challenging central banks worldwide to tailor effective monetary policies to achieve price stability. Inflation, which manifests as a steady rise in the overall price level, disrupts economic activities by eroding purchasing power, distorting consumption, and disincentivizing savings and investments (Ozili, 2020). Controlling inflation is a primary objective of monetary policy due to its critical role in ensuring economic stability. However, achieving this goal has proven complex, particularly in developing economies where economic structures are vulnerable to external shocks (Ozili, 2020). Recent studies suggest that financial inclusion (FI) could offer a sustainable solution by enhancing access to formal financial systems, thereby promoting economic resilience (Omar & Inaba, 2020; Olusola et al., 2022). This was particularly evident during the COVID-19 pandemic, which expedited the implementation of digital payments. The Global Findex Database (2021) revealed that approximately 40% of adults in developing nations, apart from China, used merchant payments digitally, signalling a shift towards financial digitization. Governments and central banks increasingly acknowledge the role of FI in stabilising the macroeconomy and improving monetary policy efficacy (Oanh et al., 2023).

Globally, FI is a cornerstone of sustainable economic development, with significant implications for poverty alleviation, financial stability, and inclusive growth. FI is the ability of businesses and individuals to access affordable financial services and products that meet their needs in a sustainable manner (Ozili, 2020). FI is vital in maintaining macroeconomic stability and enhancing the effectiveness of monetary policies. According to the Global Findex Database (2021), 76% of adults globally own bank accounts and an increase from 51% a decade ago. Despite this progress, approximately 1.4 billion adults remain unbanked, primarily in developing economies. These financially excluded individuals lack access to essential financial products like credit and savings, which are critical for smoothing consumption and managing financial risks. Studies reveal that FI can empower underserved populations, particularly in developing economies, by reducing poverty and inequality (Omar & Inaba, 2020). However, the relationship between FI and inflation is complex. While financial inclusion can drive economic empowerment and resilience, high inflation can erode its benefits by reducing the real value of financial assets and discouraging participation in formal financial systems (Salami et al., 2018). This dynamic poses challenges for policymakers seeking to enhance financial inclusion while maintaining price stability. Inflation, as noted by Olusola et al. (2022), remains a persistent economic issue that affects consumption, savings, and investment patterns. In this context, aligning FI strategies with inflation-targeting policies is critical to creating a conducive macroeconomic environment that fosters inclusive economic growth.

Despite the recognized benefits of financial inclusion, several barriers hinder its widespread adoption, particularly in developing economies. These barriers can be divided into supply-side and demand-side constraints. Demand-side barriers include limited financial resources, low-income levels, and widespread financial illiteracy, which restrict individuals' ability to access and utilize financial services effectively (Lenka & Bairwa, 2016). On the supply side, the challenges are equally significant. Limited availability of financial infrastructure like ATMs and bank branches, coupled with high transaction costs, deters access to formal financial systems. In many regions, the lack of necessary documents for account opening and the stringent conditions for obtaining credit further exacerbate the issue. According to the Global Findex Database (2021), while the average rate of bank account ownership in emerging economies rose from 63% in 2017 to 71% in 2021, these improvements are unevenly distributed and often leave marginalized populations behind.

2. Theoretical and Literature Review

2.1 Monetary Policy Theory

Monetary policy theory has undergone significant evolution, shaped by prominent economists who sought to explain money’s role in economic stability and policy interventions (Gaffard, 2018). The foundation of this theory can be traced to classical economists like David Ricardo, whose Principles of Political Economy and Taxation (1817) established money’s primary functions such as store of value, medium of exchange, and unit of account (Fuerst & Walsh, 1999). His insights set the stage for subsequent theories on monetary policy. In the late 19th century, Walter Bagehot’s Lombard Street (1873) provided critical insights into the role of central banks, emphasizing their responsibility in maintaining financial stability during crises (Fuerst & Walsh, 1999). His advocacy for lender-of-last-resort policies influenced central banking frameworks. The 20th century witnessed major developments in monetary theory, particularly with John Maynard Keynes’ critique of classical thought. In The General Theory of Employment, Interest, and Money (1936), Keynes stated that monetary policy could be utililsed to manage aggregate demand, especially in times of economic downturns (Keynes, 1936). This perspective diverged from the laissez-faire approach, advocating for active intervention. Milton Friedman later challenged Keynesian dominance by asserting that inflation was a monetary phenomenon, stressing the importance of controlling money supply rather than discretionary fiscal policies. Friedrich Hayek, in contrast, warned against excessive monetary intervention, emphasizing free-market mechanisms and the dangers of inflationary distortions. These varying perspectives highlight the theoretical evolution of monetary policy, reflecting a continuous refinement of its principles over time (Fuerst & Walsh, 1999).

Monetary policy theory operates under several fundamental assumptions, shaping its effectiveness and limitations. One key assumption is that central banks can accurately assess economic conditions and adjust interest rates or money supply accordingly (Fuerst & Walsh, 1999). The belief in rational expectations among market participants also underpins monetary policy’s efficacy, assuming that individuals and businesses respond predictably to policy changes. Another critical assumption is that monetary policy is the primary tool for macroeconomic stabilisation, often prioritized over fiscal policy interventions (Fuerst & Walsh, 1999). This assumption aligns with the monetarist view, which emphasizes controlling money supply to regulate inflation. Furthermore, monetary theory presupposes that inflation targeting, guided by transparent communication from central banks, fosters economic stability by anchoring inflation expectations (Fuerst & Walsh, 1999). The independence of central banks is another assumption that enhances credibility, as political interference is believed to cause suboptimal policy decisions. However, these assumptions are not universally valid. Central banks often struggle with accurate forecasting due to economic complexities, and rational expectations may not always hold true in uncertain environments. Additionally, the prioritization of monetary policy over fiscal interventions can be problematic in crises requiring direct government spending. Therefore, while monetary policy theory presents a structured framework, its underlying assumptions are subject to real-world challenges that limit its applicability in all scenarios (Fuerst & Walsh, 1999).

Despite its strengths, monetary policy theory has notable weaknesses, two of which are particularly significant: the issue of long and variable time lags in policy implementation and its inefficacy at the zero lower bound (Fuerst & Walsh, 1999). Monetary policy decisions like adjusting interest rates or altering the money supply, take time to influence the economy due to transmission mechanisms that affect investment, consumption, and inflation gradually. This lag creates uncertainty, making it difficult for central banks to time their actions precisely, leading to potential overcorrections or insufficient responses. This limitation is exacerbated by unpredictable economic shocks that disrupt monetary policy effectiveness. Another major weakness is the zero lower bound (ZLB) problem, where nominal interest rates cannot be lowered beyond zero (or slightly negative), rendering traditional monetary tools ineffective in severe downturns. This was apparent during the 2008 financial crisis, when central banks employed unusual measures like quantitative easing due to the inability to reduce interest rates further. However, such measures have distributional consequences, disproportionately benefiting asset holders and exacerbating wealth inequality. Thus, while monetary policy remains a crucial economic tool, its weaknesses highlight the need for complementary fiscal policies and structural reforms to address economic instability more comprehensively (Fuerst & Walsh, 1999).

Monetary policy theory is highly relevant to both financial inclusion and inflation, as it influences the availability of credit, interest rates, and overall economic stability. Through instruments like reserve requirements, open market operations, and policy rates, central banks regulate money supply and ensure financial markets operate efficiently. Financial inclusion benefits from accommodative monetary policies that lower interest rates, making credit more affordable for low-income individuals and small businesses. When central banks promote stable inflation and financial accessibility, underserved populations can integrate into the formal economy, improving economic participation. However, poorly managed monetary policies can lead to inflationary pressures, reducing the purchasing power of individuals, particularly those with limited financial resources. High inflation can also discourage savings and investment, exacerbating financial exclusion. Therefore, a well-calibrated monetary policy is essential for balancing inflation control with expanding financial access.

2.2 Empirical Review

Kebede, Selvanathan, and Naranpanawa (2024) utilized a heterogeneous panel SVAR model to investigate how financial inclusion influences the effectiveness of inflation-targeting monetary policy within the West African Economic and Monetary Union. Their research revealed that financial inclusion shocks generally result in short-term inflationary effects. However, deposit-related factors like the number of commercial bank depositors per 1,000 adults, contribute to inflation reduction, while credit-related factors, such as the proportion of domestic credit to the private sector relative to GDP, tend to exacerbate inflationary pressures.

Oanh et al. (2023) explored the intricate relationships among financial inclusion, financial stability, and monetary policy, emphasizing financial development across multiple nations. By applying Panel Vector Autoregression (PVAR) and impulse response analysis to data spanning 2004 to 2020, they determined that financial stability and financial inclusion are positively associated in countries with underdeveloped financial systems. In contrast, in economies with well-developed financial sectors, financial inclusion and inflation negatively correlate with financial stability. The variance decomposition analysis further suggested that financial inclusion fosters stability and mitigates inflation in less-developed regions, while the reverse holds in advanced economies.

Focusing on major emerging markets, Ozili (2023) assessed the influence of monetary policy on financial inclusion between 2004 and 2020. His findings demonstrated that higher interest rates discourage bank deposits but promote the expansion of bank branches. The research also highlighted that the impact of monetary policy—whether contractionary or expansionary—varies across different financial inclusion indicators. Notably, post-financial crisis periods showed that rising interest rates had a uniformly negative effect on financial inclusion.

Jungo (2022) analyzed financial inclusion and its interaction with monetary policy in Latin America, Sub-Saharan Africa (SSA), and the Caribbean (LAC). Using Principal Component Analysis (PCA) to construct a financial inclusion index and employing PVAR for empirical analysis, the study concluded that financial inclusion improves the effectiveness of monetary policy in SSA, while in LAC, broader access to financial services improves monetary policy efficiency. The research underscored the need for policies that encourage investment and expand financial services in developing economies to support inflation control.

In a study covering 15 West African nations from 2005 to 2020, Dauda (2022) examined how financial inclusion influences the efficiency of the interest rate channel in monetary policy transmission. By applying PCA to formulate a financial inclusion index and employing GMM regression analysis, the study established that higher financial inclusion strengthens the effectiveness of interest rate-based monetary policy.

Examining ASEAN countries from 2010 to 2019, Komala and Widodo (2022) applied the Vector Error Correction Model (VECM) and used a Financial Inclusion Index (FII) derived from PCA, incorporating dimensions such as financial usage, access, and service quality. Their study demonstrated that financial inclusion contributes to inflation reduction, implying that monetary policy is more effective in the region when controlling for variables like exchange rates, money supply, and lending interest rates.

Salisu (2022) analyzed data from 2010 to 2020 to assess the relationship between financial inclusion, monetary policy, and economic growth in developing nations. Using the GMM approach, the study reached a conclusion that financial inclusion and monetary policy play a significant role in driving economic growth in these economies.

3. Methodology

Ex-post facto research design was adopted for this study. Ex-post factor research design was employed because the fact of the study has occurred prior to the commencement of the study. Hence, the researcher has no influence on the fact of the study. Secondary data were collected from Central Bank of Nigeria statistical bulletin from 2000 to 2021. This study employs Autoregressive Distributed Lag (ARDL) model. The model is suitable for analyzing the impact of financial inclusion on monetary policy in Nigeria because it effectively handles variables that are integrated at different levels.

3.1 Specification of Research Model

The model of this study was specified as follows:

INF= f(CBSD, CBCSMA, CIC, NCBB, DRBCB, NRMM, NMMT)………………………….(1)

Econometrically, the model was stated as:

INFt = β0 + β1CBSDt + β2CBCSMAt + β3CICt + β4NCBBt + β5DRBCBt + β6NRMMt +

β7NMMTt + ϵt………………………………………………………………………(2)

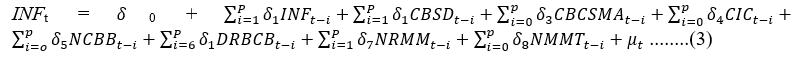

The ARDL model is presented below:

Where: INF = Inflation

CBSD = Commercial banks savings deposit

CBCSME = Commercial banks credit to small and medium scale enterprises CIC = Currency in circulation

NCBB = Number of commercial banks branches

DRBCB = Deposits of rural branches of commercial banks

NRMM = Number of Registered Mobile Money Account

NMMT = Number of Mobile Money Transactions β0 is the intercept term.

β1, β2, β3, β4, β5, β6, β7 are the long-run coefficients showing the relationship

between monetary policy and each independent variable.

ϵt is the error term.

4. Analysis of Data and Results Interpretations

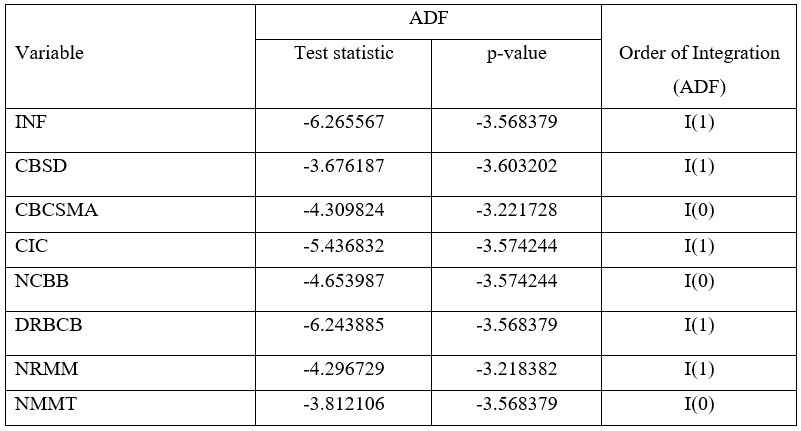

Table 1: ADF Unit Root Test Results

Source: Authors computation (2024)

Time series data often exhibits patterns and typically lacks stability. Using OLS when analysing the connection of a nonstationary variables on another nonstationary variable which might lead to erroneous regression results. The results obtained from the ADF test indicated that CBCSMA, NCBB and NMMT demonstrate stationarity at the level, whereas INF, CBSD, CIC, DRBCB and NRMM exhibit integration of order one (I(1)) rather than zero. Hence, it is crucial to do an ARDL Bound Test to determine the cointegration of the variables by examining the combination of I(0) and I(1) stationarity.

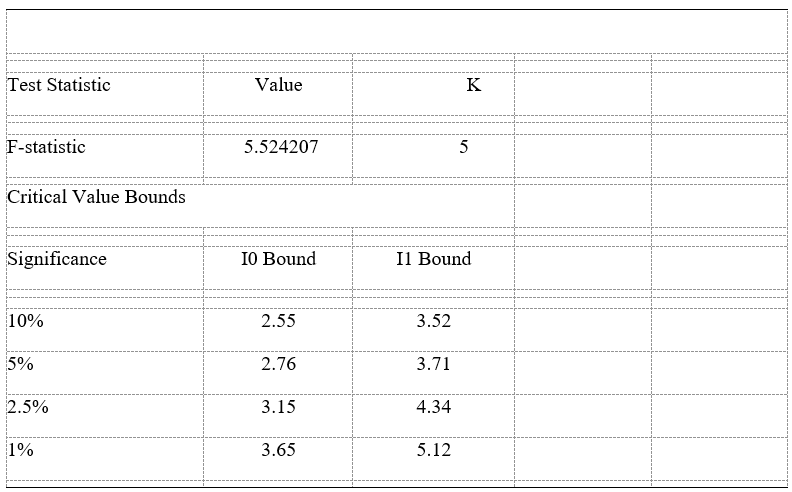

Table 2: ARDL Bound Test for Inflation

Source: Author’s Computation, 2024

The results of Table 2 revealed a bound test F-statistics of 5.524207 had a higher value compared to the value of upper bound of 3.71 at a significance level of 5%. The aforementioned observation identifies the presence of an enduring associations among the variables. Therefore, this result facilitated the advancement to ARDL model estimate.

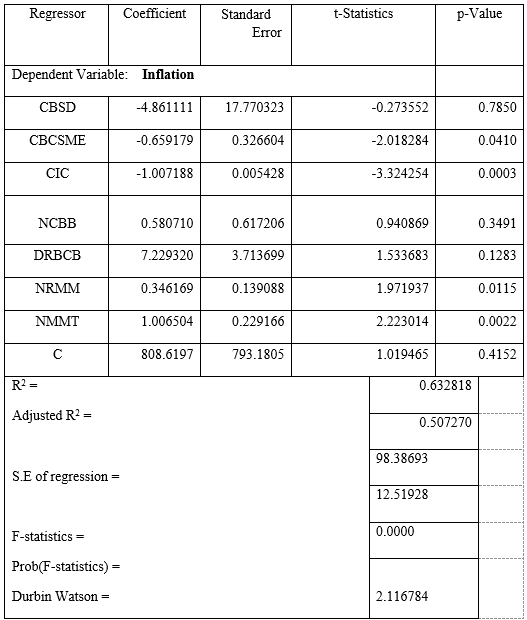

Table 3: Estimated Long-run Coefficients Based on ARDL for Inflation

Source: Author’s Computation, 2024

The data presented in Table 3, the R-squared value is 0.632818, suggesting a substantial degree of adequacy in the model's fit. The data suggest that the Commercial banks savings deposit, Commercial banks credit to small and medium scale enterprises, Currency in circulation, Number of commercial banks branches, Deposits of rural branches of commercial banks, Number of Registered Mobile Money Account and Number of Mobile Money Transactions collectively explained 63.2% of the observed fluctuations in inflation. The revealed F-statistic of 12.51928, associated with p-value of 0.0000, provides evidence supporting the reliability of the model. The findings indicate that the model exhibits a fair degree of adequacy and reliability in producing accurate predictions.

Commercial banks savings deposit coefficient (CBSD), as presented in Table 4.3, is -17.861111, accompanied p-value of 0.0051. The results depicted an indirect linkage of CBSD and inflation. Likewise, Commercial banks credit to small and medium scale enterprises and Currency in circulation exhibit an indirect and statistically significant impact on inflation, as depicted with coefficient of -0.659179 and -1.007188 and p-values of 0.0410 and 0.0003 respectively. However, Number of Registered Mobile Money Account and Number of Mobile Money Transactions exhibited an indirect but significant impact on inflation, as evidenced by coefficient of 0.346169 and 1.006504 as well as p-values of 0.0115 and 0.0022 respectively. The statistical analysis revealed that financial inclusion impact on monetary policy in Nigeria.

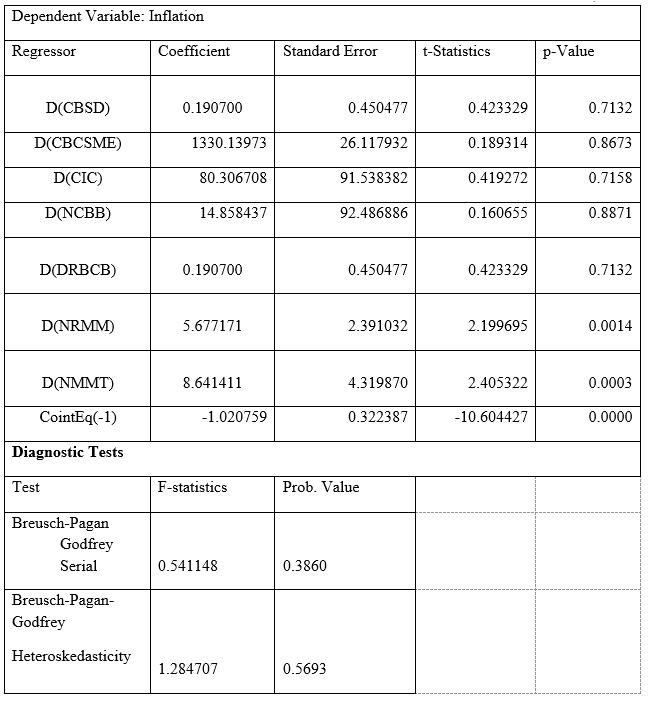

Table 4: Short run Results and Diagnostics Tests results

Source: Author’s Computation, 2024

Table 4. above depicted the outcomes of the model's short-term dynamics. The long-term connections among variables of the model is provided by the significant but negative estimate of CointEq(-1). The results also indicate that the estimated value of CointEq(-1) is -1.020759, which significantly affect at a 1 percent significance level. The results of the test presented suggested no evidence of serial correlations. Furthermore, no evidence of mis-specification error is seen. In addition, the Breusch-Pagan heteroskedasticity statistics of 1.284707, along with p-values of 0.5693, suggest that there is no evidence of heteroskedasticity in the models. Based on the absence of statistical significance in the statistical analysis and the inability to reject the null hypothesis of equal variance in the test, this conclusion can be inferred.

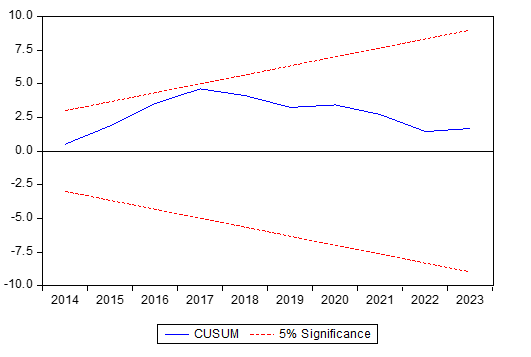

Fig 1: CUSUM Tests

4.1 Stability Tests

The inquiry continued with tests to evaluate the stability of long-term coefficients using cumulative sum of residuals (CUSUM) tests. It is imperative that the CUSUM value remains inside the two crucial lines in order to ensure stability at 5% significance level. However, when the lines fall outside these lines then there exists an instability of the model. The data illustrates that the CUSUM plot is situated within the crucial bounds. Therefore, it can be inferred that the parameters of the model demonstrate stability.

5. Conclusion and Recommendations

Data analysis and study results showed that while Commercial banks credit to small and medium scale enterprises had no substantial negative impact on inflation in Nigeria. The study also concludes that a relationship existed between number of registered mobile money account and financial inflation as well as a positive relationship between number of mobile money transactions and inflation in Nigeria. Based on these results, the study concluded that financial inclusion affect inflation in Nigeria. The study recommends that financial institutions, especially commercial banks in Nigeria, expand their loans to the small and medium scale enterprises for more profitable investments in light of the results and conclusions derived from them. This will improve domestic investment, expand the size of the financial sector's expansion, and increase access to investible money. Finally, monetary authorities in Nigeria should put measures in place to always ensure financial inclusiveness. This will go a long way in reducing uncertainty regarding investment opportunities and encourage investors to put their funds in the local markets.

References

Abimbola, A., Olokoyo, F. O., Babalola, O., & Farouk, E. (2018). Financial inclusion as a catalyst for poverty reduction in Nigeria. International Journal of Scientific Research and Management (IJSRM), 6(06), 481-490.

Ali, A. K., & Asfaw, D. M. (2023). Nexus between inflation, income inequality, and economic growth in Ethiopia. PLoS ONE, 18(11), e0294454.

Anthony, A., Sambuli, N., & Sharma, L. (2024). Security and Trust in Africa’s Digital Financial Inclusion Landscape. USA: Washington, DC. Carnegie Endowment for International Peace

Anzoategui, D., Demirgüç-Kunt, A., & Martínez Pería, M. S. (2014). Remittances and Financial Inclusion: Evidence from El Salvador. World Development, 54, 338–349.

Bilalli, A., Sadiku, M., & Sadiku, L. (2024). The Impact of Inflation on Financial Sector Performance: Evidence from OECD Countries. Economics, 12(2), 263–276.

Central Bank of Nigeria. [CBN] (2012). National Financial Inclu Summary Report Abuja, 20 January 2012 National Financial Inclusion Strategy. https://www.cbn.gov.ng/Out/2012/publications/reports/dfd/CBN-Summary%20Report%20of-Financial%20Inclusion%20in%20Nigeria-final.pdf

EFInA. (2024, December 30). Access to Financial Services in Nigeria survey - EFInA: Enhancing Financial Innovation and Access. EFInA: Enhancing Financial Innovation and Access. https://efina.org.ng/our-work/research/access/#:~:text=2023%20Survey%20The%202023%20results%20show%20that,exclusion%20in%20Nigeria%20to%2025%%20by%202024.

Feyen, E., & Huertas, I. (2020). Bank Lending Rates and Spreads in EMDEs Evolution, Drivers, and Policies. Policy Research Working Paper 9392.

Ha, J., Kose, M., Ohnsorge, F., & Yilmazkuday, H. (2023). What Explains Global Inflation. Policy Research Working Paper 10648

Lenka, S. K., & Bairwa, A. K. (2016). Does financial inclusion affect monetary policy in SAARC countries?. Cogent Economics & Finance, 4(1), 1127011.

Mbiti, I., & Weil, D. (2011). Mobile Banking: The impact of M-PESA in Kenya. NBER Working Paper No. 17129. https://doi.org/10.3386/w17129

Muritala, T. (2011). Investment, Inflation and Economic Growth: Empirical Evidence from Nigeria. Research Journal of Finance and Accounting Www.iiste.org ISSN, 2(5), 2222–2847.

Nnaomah, N. U. I., Aderemi, N. S., Olutimehin, N. D. O., Orieno, N. O. H., & Ogundipe, N. D. O. (2024). Digital Banking and Financial Inclusion: A Review of Practices in the USA And Nigeria. Finance & Accounting Research Journal, 6(3), 463–490.

Oanh, T. T. K., Van, L. T. T., & Dinh, L. Q. (2023). Relationship between financial inclusion, monetary policy and financial stability: An analysis in high financial development and low financial development countries. Heliyon, 9(6), e16647.

Olusola, B. E., Chimezie, M. E., Shuuya, S. M., & Addeh, G. Y. A. (2022). The Impact of Inflation Rate on Private Consumption Expenditure and Economic Growth—Evidence from Ghana. Open Journal of Business and Management, 10(04), 1601–1646.

Omar, M. A., & Inaba, K. (2020). Does financial inclusion reduce poverty and income inequality in developing countries? A panel data analysis. Journal of Economic Structures, 9(1), 1-25.

Ozili, P. K. (2020). Theories of financial inclusion. SSRN Electronic Journal, 1-23. https://doi.org/10.2139/ssrn.3526548

Parvin, S. M. R., & Panakaje, N. (2022). A study on the prospects and Challenges of digital financial inclusion. International Journal of Case Studies in Business IT and Education, 469–480.

Rapu, S., Gaiya, B., Eboreime, M., Nkang, M., Audu, N., Golit, P., Okafor, H., Aremu, A., & Alley, I. (2016). A Quantitative Exploration of the Drivers of Inflation in Nigeria. Economic and Financial Review, 54/2, 1-60.

Salami, A., Kelikume, I., & Iyoha, F. (2018). Time Series Modeling and Forecasting Inflation: Evidence from Nigeria. The International Journal of Business and Finance Research, 8(2), 41-51.

Salisu, A. A., & Fasanya, I. O. (2012). Modelling oil price volatility with structural breaks. Energy Policy, 52, 554–562.

Recebido: 08/02/2025

Aceito: 01/04/2025

------------

Notas

[1] Department of Accounting Science, Walter Sisulu University. ORCID: https://orcid.org/0009-0004-8746-0700 E-mail: c.emmanueloyasor@gmail.com