Earnings management in emerging economy: what is the mitigating role of adopting IFRS?

GESTÃO DE RESULTADOS NA ECONOMIA EMERGENTE: QUAL O PAPEL MITIGANTE DA ADOÇÃO DO IFRS

Segun Abogun [1]

Nasirudeen Abdullahi [2]

Ramat Titilayo Salman [3]

Mubarak Abiodun Orilonise [4]

DOI: 10.23925/2446-9513.2025v12id70883

ABSTRACT

Earnings management, a global concern with detrimental impacts on firms and stakeholders, has prompted extensive academic inquiry. This study investigates the influence of corporate governance mechanisms and the adoption of International Financial Reporting Standards (IFRS) on earnings management among Nigerian manufacturing firms. Using a balanced panel of 668 firm-year observations from 52 listed companies between 2007 and 2022, the research employs fixed and random effects models alongside Two Sample t-tests. The findings indicate significant differences in earnings management pre- and post-IFRS adoption, with independent board size and audit committee composition significantly affecting earnings management. The study concludes that IFRS adoption and corporate governance mechanisms play crucial roles in moderating earnings management.

Keywords: earnings management, corporate governance, IFRS, Nigerian manufacturing firms, audit committee, board size.

RESUMO

A gestão de resultados, uma preocupação global com impactos prejudiciais nas empresas e nas partes interessadas, suscitou extensas investigações académicas. Este estudo investiga a influência dos mecanismos de governança corporativa e a adoção das Normas Internacionais de Relatórios Financeiros (IFRS) no gerenciamento de resultados entre empresas industriais nigerianas. Utilizando um painel equilibrado de 668 observações anuais de 52 empresas cotadas entre 2007 e 2022, a investigação emprega modelos de efeitos fixos e aleatórios juntamente com testes t de duas amostras. As conclusões indicam diferenças significativas na gestão de resultados antes e após a adopção das IFRS, com a dimensão independente do conselho e a composição do comité de auditoria a afectarem significativamente a gestão de resultados. O estudo conclui que a adoção das IFRS e os mecanismos de governança corporativa desempenham papéis cruciais na moderação do gerenciamento de resultados.

Palavras-chave: Gestão de resultados, governança corporativa, IFRS, empresas industriais nigerianas, comitê de auditoria, tamanho do conselho.

1. Introduction

The ethical view of businesses has become a global trending issue from the rise in corporate dishonesty and accounting related fraud. As a response to the financial scandals around the world and the collapse of major corporate institutions in the early 2000s, globalization of the economy, the International Accounting Standard Board perceived the need for international standardization of accounting systems to boost investor’s confidence by introducing more rigorous regulations which led to formation of the International Financial Reporting Standard (Sellami and Fakhfakh, 2014). The scandals and collapse of some of these multinational companies is said to be as a result of unethical accounting practices. One of these unethical practices is earnings management, which is a strategic tool used by management under the pretext of shareholders wealth maximization. This hereby arose the high demand for an accounting standard that will be adopted by practitioners to present uniform financial information across the globe. International Financial Reporting standard (IFRS) played the primary role to ensure uniformity in preparation of accounting statement, this has ensured that financial statements prepared by adopting these standards are comparable and understandable to it users thereby enhancing the quality of the information. (IFRS) provides a standard reporting framework that ensures accountability, efficiency, and transparency in global capital markets. It helps harmonize financial reporting practices in different countries to enhance comparability.

The voluntary adoption of IFRS according to Barth et al (2008) is said to reduce earnings management practice and increase the value of accounting amount. Despite the increase in IFRS adoption around the world only 21 out of the 54 countries is Africa has mandated its adoption while 5 countries has permitted it raising from the lack of local accounting standards (Tawiah and Boolaky 2020). Despite several financial legislations, accounting standards, codes of corporate governance and stock exchange regulations guiding how financial statements are being prepared and presented, accounting scandals still continue to surface both in developing and developed economies around the globe. It is a common belief among analysts that at least three factors are into play and dominate in almost every day media report of financial scandals. These factors include: laxity in the audit process as well as relaxed accounting standards and oversights, failed corporate governance mechanisms, and the incentives, at times perverse, provided by executive compensation systems (Hamdan, 2020; Canada Senate, 2003). A central cause of these accounting scandals was usually the phenomenon of earnings management (Hamdan, 2020; Goncharov, 2005).

Abdullahi & Mansor (2015) asserts that earning management is a difficult task to need a long time to investigate and disclose. Thus, understanding how institutions can provide the incidence of frauds and assist the company resources and increase stakeholders trust. Hence, manipulations and financial frauds are not a new practice in the firms. This resulted that many companies have emerged to hire professional forensic accountants for decreasing frauds and manipulations. Corporate failings in Nigeria have spurred increased research into the impact of corporate governance practices in Nigeria and researchers noted that this particular domain is poorly studied in comparison to the rising cases of misconduct and non-compliance (Dong, Wang, Zhang & Zhou, 2020; Harris et al., 2019). Prior studies in this area have focused majorly on how corporate governance characteristics impact the occurrence of earnings manipulation within the financial services industry like commercial banks and insurance companies. In this study, Independent Board size and Audit Committee Composition are the key variables used as proxies for corporate governance.

Also, the audit committee and board independence were also identified as key factors to reduce earnings management practice by the managers, although studies on board gender diversity, such as those by Aisha (2021); Onuoha, Joshua, Sarutu & Agbi (2021) and Olufemi (2021), found that board gender diversity does not affect the quality of financial report. Therefore, this research aims to delve into the effects of corporate governance on earnings management and explore whether the implementation of International Financial Reporting Standards (IFRS) could serve as a transformative remedy to these endemic problems. The study investigate the pivotal roles of board independence and audit committee composition in safeguarding financial integrity, addressing gaps left by previous studies Aisha (2021); Onuoha, Joshua, Sarutu & Agbi (2021) and Olufemi (2021) and exploring new dimensions in the independent board size and composition of audit committees as mandated by CAMA 2020. This study not only probes the complex interplay between corporate governance and earnings management but also evaluates how the adoption of IFRS could potentially enhance financial transparency and restore stakeholder confidence in emerging markets like Nigeria.

2. Literature review and hypothesis Development

2.1 Theoretical framework

Agency theory.This study is built on agency theory being a theory of organizational process, behavior and outcome. Agency theory provides insight and understanding of corporate processes and designs to address emerging problems from the principal–agent relationship. According to (Alfadhael & Jarraya, 2021; Jensen & Meckling, 1976), the principal–agent relationship is defined as a contract under which one or more persons (the principal) engage another person (the agent) to perform some services on their behalf which involves delegating some decision making authority to the agent.

In contemporary literature, agency theory emerges as a prominent framework for explaining behaviors surrounding earnings management. It posits a clash of interests between management and shareholders, wherein managers might prioritize their own concerns over those of shareholders (Alfadhael & Jarraya, 2021; Liu et al., 2010). The resultant expenses arising from this conflict are termed agency costs. According to agency theory, managers tend to favor their own advantages over those of other stakeholders, necessitating mechanisms like performance-based compensation to counteract this inclination and promote responsible stewardship of the enterprise. As a result, managers are motivated to partake in earnings management tactics to bolster their personal financial interests.

To safeguard their interests or stay in their position, agents are willing to provide shareholders with a favorable view of the company's financial status, according to Alfadhael & Jarraya (2021). However, agency problems arise when the agent's wealth maximization is not always achieved in parallel with the shareholders' capital maximization. It is plausible that directors may experience pressure to manipulate compensation to enhance their sense of value. The author further contends that companies will incur significant agency fees if they participate in dishonest earnings management. However, if managers are in charge of and oversee the management of shareholdings, then managers' and owners' objectives ought to coincide to reduce earnings management, as managers and shareholders have an equal stake in the business.

From a research perspective, agency theory is a theory that explains and predicts agency problem/agency cost. It further explains and predicts managerial and organizational behavior and outcomes. The assumptions of agency theory include the followings: (1). it comprises two parties: principal and agent. The principal is expected to supply the capital, bear risks and construct incentives, while the agent is required to complete the tasks, make decisions on behalf of the principal and to bear risks (of a secondary type). (2). the outcome of the firm’s performance is observable/measurable and can be contracted upon. (3). it is not always that the interest of the principals and agents are aligned (Bebuck et al., 2000). (4). the efficiency of the principal–agent relationship depends on individualistic and opportunistic interest held by each party. (5). agency cost is increased by information asymmetry.

From this theory therefore, it can be deduced that earnings management is a form of agency cost. This is so because the practice of earnings management by managers toward achieving their target and consequently incentive bonus at all cost is a possible problem capable of affecting organizational outcome negatively. Organizational outcome is multidimensional which may take the form of financial performance; operational performance; stock market performance and corporate failures. Since the opportunistic behavior of managers affects organizational outcome, it is expected that self-motivated management of earnings would affect firm value. Based on this expectation, this study hypothesized the following hypothesis: earnings management has no significant difference between pre and post IFRS adoption amongof listed manufacturing companies in Nigeria, independent Board Size has no significant relationship on earnings management in post IFRS adoption period among the listed manufacturing companies in Nigeria, audit Committee Composition has no significant relationship on earnings management in post IFRS adoption period among listed manufacturing companies in Nigeria and IFRS adoption has no significant moderating effect on the relationship between earnings management and corporate governance of listed manufacturing companies in Nigeria.

3. Methodology

3.1 Data source and sample

Secondary source of data was employed in this study. As such, data were extracted from the financial reports of sampled firms. The population of the study consists of all listed manufacturing firms sector on the Nigeria Exchange Group except the firms in the financial and service sector. These were exempted because the industry is relatively highly regulated. Including such sectors into the data stream could introduce large heterogeneity capable of distorting the result of this study.

As a result, a sampling frame consisting a total number of fifty-two (52) listed industries in the manufacturing firms sector was used. Therefore the whole fifty-two selected manufacturing firms fromvarious sectors form sample size for this study. According to Bluman (2009, p. 360), the central limit theorem posits that “approximately 95% of the sample means fall within 1.96 SD of the population mean if the sample size is thirty (30) or more”

3.2 Empirical model

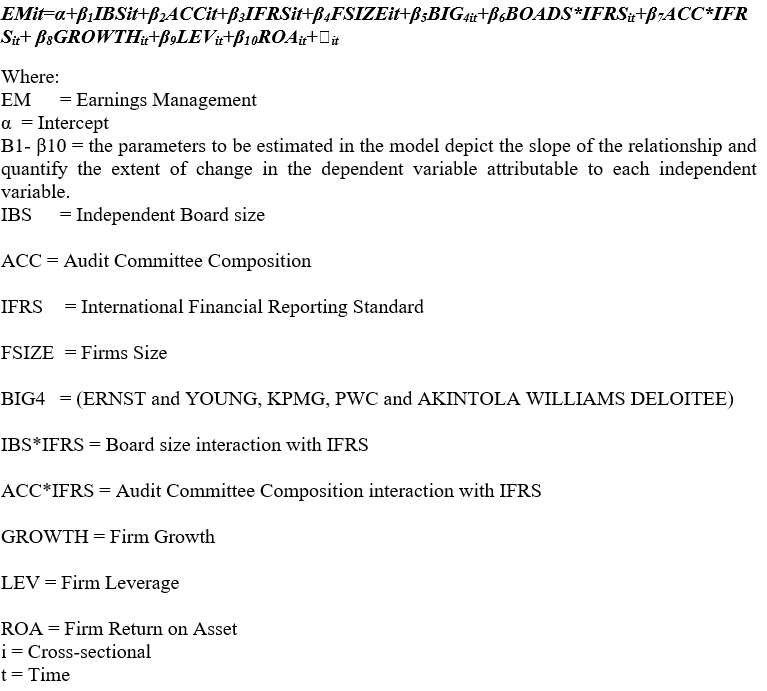

The functional model for this study is specified as:

3.3 Variable measurement

3.3.1 Earnings management

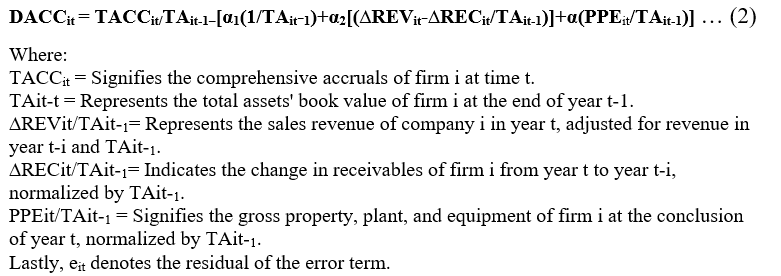

The degree of earnings management is measured in this study using the discretionary component of accruals. The accruals for discretion are calculated in two stages. Total accruals (TA) are determined in the first phase using a method based on the Statement of Financial Position (Hribar & Collins, 2002;Abogun et al. 2020). The income statement's accrual elements (revenues and expenses) and the net working capital accounts on the Statement of Financial Position are believed to have a connection, serving as the foundation for Statement of Financial Position estimation (Paulo, 2007). A number of writers, including Hirshleifer et al.(2009), Kang et al.(2010), Dechow et al.(2012), Martinez (2008), and Medeiros et al. (2019), have estimated accruals using the Statement of Financial Position technique. Total accruals can be estimated by referencing the Statement of Financial Position using the following method:

A modified Jones model (Dechow et al., 1995; Medeiros et al., 2019) was used in the study's second phase as a stand-in for accrual earnings management. This modification seeks to differentiate between discretionary and non-discretionary accruals in order to alleviate some of the prior shortcomings of the Jones model. It is assumed that non-discretionary accruals are a predictable, linear function of variations in sales, corrected for variations in the amount of property, plant, and equipment and accounts receivable. Thus, in line with previous studies, we performed regressions using these identified accruals determinants on the total accruals (TA) obtained in the first phase.

2. BIG4:The major audit firms consist of KPMG, Deloitte, Ernst & Young, and PricewaterhouseCoopers (PWC). Therefore when a business uses one of the Big Four audit firms (KPMG, Deloitte, Ernst & Young, or PricewaterhouseCoopers) the dummy variable takes on the value of "1"; otherwise, it takes on the value of "0".

Growth:Determine the revenue variation by deducting the prior period's revenue from the current period's revenue, then dividing the result by the prior period's revenue.

3. Independent Board size:Under CAMA 2020, all public companies are required to have at least three independent directors on the Board, the dummy variable takes on the value of "1"; otherwise, it takes on the value of "0".

4. Audit Committee composition:In CAMA 2020, the audit committee of a public company should have 5 (five) members i.e., 3 (three) shareholders and 2 (two) non-executive directors with at least one member being a member of a professional accounting body in Nigeria established by an Act of the National Assembly. Dummy variable takes “1”, otherwise it takes “0”.

5. Firm size: Larger firms have a greater incentive to earnings management. Firm size in this study is measured by the logarithm of total assets.

6. Leverage: This was included in the study model to control for differences in the capital structure of the sampled firms .It is measured as the ratio of long-term debt to total assets.

7. Return on Assets:Total profit after tax divided by the total assets.

8. International Financial Reporting Standard:Dummy variable which is equal to “0” between 2007 and 2011 and “1” if company uses IFRS between, 2012 and 2022.

3.4 Estimation technique

The study defined and estimated panel regression models. The Hausman test was used to assess which estimating method fixed effect (inside estimator) or random effect (between estimators) was more suited. Consequently, the models were estimated using a fixed effect estimation technique because the Hausman test result indicated that the firm-specific characteristic was significant but not random. Pool-ability was examined under the assumption that the sampled firms throughout the period under consideration showed homogeneity in order to ascertain whether the panel data could be pooled. However, the observation from the sample firms from each variable in the study were of varying sizes hence the tendency of large variance across firms. As a result, OLS method with robust standard error was employed in estimating the yearly cross-sectional model. This was done to address the issue of heteroscedasticity which is one of the violations of the basic assumptions of the traditional Ordinary Least Square (OLS) estimation technique. Moreover, the T-statistics and F-statistics were used to test the hypotheses and the fitness of the models, respectively.

4. Results and discussion

4.1 Summary statistics

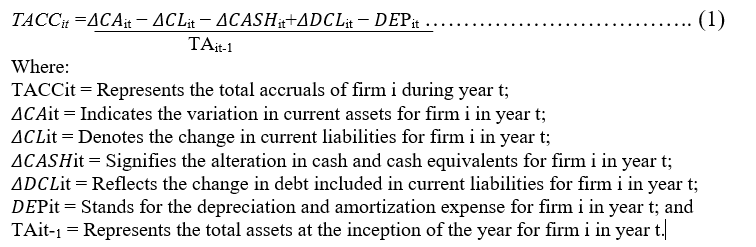

Table 1. Descriptive statistics

Source: Researchers computation (2024).

Table 1 displays comprehensive descriptive statistics for both the dependent and independent variables of the research. According to the data provided in the table, it is evident that the lowest level of EM among the manufacturing firms listed in Nigeria is recorded at -1.54%. This suggests the existence of firms with an average level of EM practice among manufacturing entities in Nigeria. However, company with the highest possibility of earnings manipulation has about 3.19%, while the average in the sector is -3.02% implying that, manufacturing firms in Nigeria are in line with the theoretical proposition of Healy (1985) and the empirical work of Uwuigbe and Jimoh (2009) that manufacturing firms in Nigeria tend to overstate earnings as a result of beating or meeting the analyst forecasts.

Additionally, the outcome of the descriptive data shows that audit quality contributed, on average, 62%. This suggests that approximately 74% of the sampled manufacturing companies complied with IFRS during the time under consideration, although approximately 62% of the firms chosen underwent audits by the BIG4 (ERNST and YOUNG, KPMG, PWC and AKINTOLA WILLIAMS DELOITEE). (IBS), Mean = 0.54 which implies that earnings management practice in Nigerian manufacturing firms increases despite the larger size of board implying that small board size are more capable to reduce earnings manipulations in the firms as a result of efficiency attached to a smaller number where larger size leads to redundancy and reluctance. The mean value of Audit Committee Composition (ACC) stands at 0.91, suggesting that typically, a company's audit committee consists of approximately three members on average. The size of firms was assessed by taking the natural logarithm of their total assets, resulting in an average of 10.07 and a standard deviation of 1.09. This indicates substantial diversity among manufacturing companies listed in Nigeria in terms of their size. Such diversity likely arises from variations in company sizes within this sector. Financial leverage was assessed using the total debt to total assets ratio, with a mean value of 0.46 and a standard deviation of 5.42. The range of this ratio was substantial, with a maximum of 104.60 and a minimum value of 0. The standard deviation of the sample firms for financial leverage was also higher than the mean and this could be justified by the losses suffered by some of the sampled companies. Return on assets was calculated as the net profit after tax to total assets ratio, resulting in a mean value of 0.53 and a standard deviation of 6.08. The higher standard deviation compared to the mean suggests that some sampled firms experienced significant losses. Revenue growth was assessed through the percentage alteration in revenues, showing an average value of 6.23 and a standard deviation of 1.47. Furthermore, all variables have a normal distribution according to the analysis of skewness and kurtosis, which evaluates normality and finds outlier or extremes within the variables. This implies that there is no outlier bias in the collected data, which increases the data's suitability for generalization.

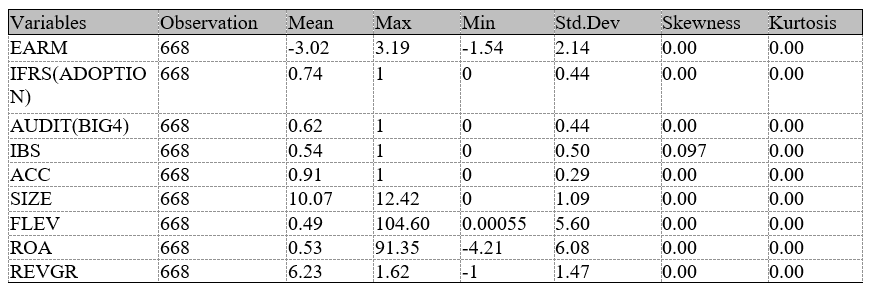

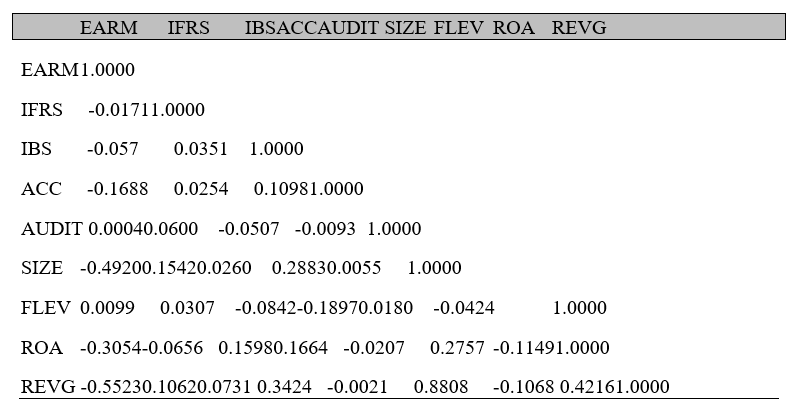

Table 2. Correlation matrix.

Source: Researchers computation (2024).

According to the sampled firms' correlation matrix results, there is a negative connection of up to 1.17% between IFRS and earnings management in Nigerian listed manufacturing companies. This suggests that the implementation of IFRS lessens the likelihood that Nigerian manufacturing companies that are publicly traded will manipulate their earnings. Document a noteworthy inverse association between Board Size (IBS) and earnings management of 6%. The association suggests that there is a decrease in earnings management with a greater board size. Additionally, the Audit Committee Composition (ACC) and the Earnings Management Variable (17%), both showed negative relationships. This shows that listed industrial companies in Nigeria have less of an incentive to manipulate their earnings due to the makeup of their audit committee. The firm's size (SIZE) exhibited a significant negative correlation of 5% with the earnings management factor. This indicates that as the firm expands in size, there is a tendency for earnings management to decrease. Conversely, return on assets (ROA) exhibits a negative correlation and a strong association with earnings management, reaching 30%. Furthermore, leverage is significantly associated with earnings management at 0.9%. Notably, there is a substantial negative correlation of 51% between revenue growth and earnings management strategies. This suggests that fast-growing businesses might feel compelled to manipulate earnings in order to align with capital market projections. An in-depth examination of the correlation matrix uncovered that none of the explanatory factors showed absolute correlation, indicating that our model isn't affected by multicollinearity. Multicollinearity, arising from high correlations among explanatory variables, can skew coefficient standard errors and lead to inaccurate signs or exaggerated magnitudes in estimated model coefficients.

4.2 Differences in Earnings Management before and after IFRS Adoption

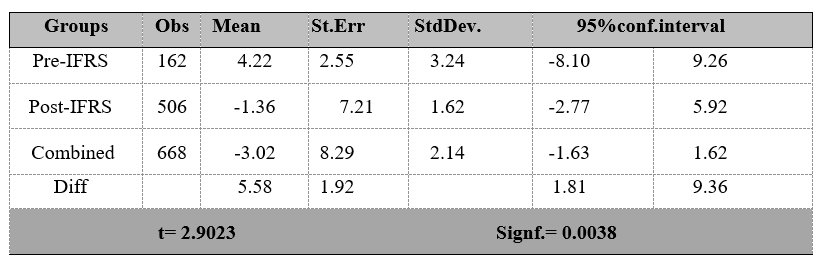

Table 3. Two Sample t-test for the Means of EM (Modified Jones Model) of Firms (Pre & Post-IFRS)

Source: Researchers computation (2024).

Table 3 illustrates the mean and standard deviation figures pertaining to the earnings management variable both prior to (Pre) and subsequent to (Post) the integration of IFRS. Preceding the implementation of IFRS, the Modified Jones Model yielded an average earnings management value of 4.22, with a standard deviation of 3.24, based on a sample size of 162. Following the adoption of IFRS, with a sample size of 506, the mean earnings management registers at -1.36, accompanied by a standard deviation of 1.62, delineating the degree of deviation from the mean. The calculated t-statistic of 2.9023 demonstrates statistical significance at the 0.0038 level. However, at the 5% (0.05) significance level, it is not considered significant. Consequently, the null hypothesis, stating "There is no significant difference in earnings management pre and post IFRS adoption" is rejected. Hence, we can infer a notable distinction as the average earnings management prior to IFRS adoption (4.22) surpasses the average earnings management post-IFRS adoption (-1.36).The significance of this lies in its contribution to our comprehension that before the introduction of the International Financial Reporting Standards (IFRS), listed companies on the Nigeria Stock Exchange Group (NGX) showed a higher tendency towards earnings manipulation compared to the period after the adoption of IFRS. These findings are consistent with previous studies by Key & Kim, (2020), Hasan & Rahman, (2019) and Barth et al. (2008), which also noted a decrease in earnings manipulation following the adoption of IFRS when compared to earlier periods.

4.3 Estimation results

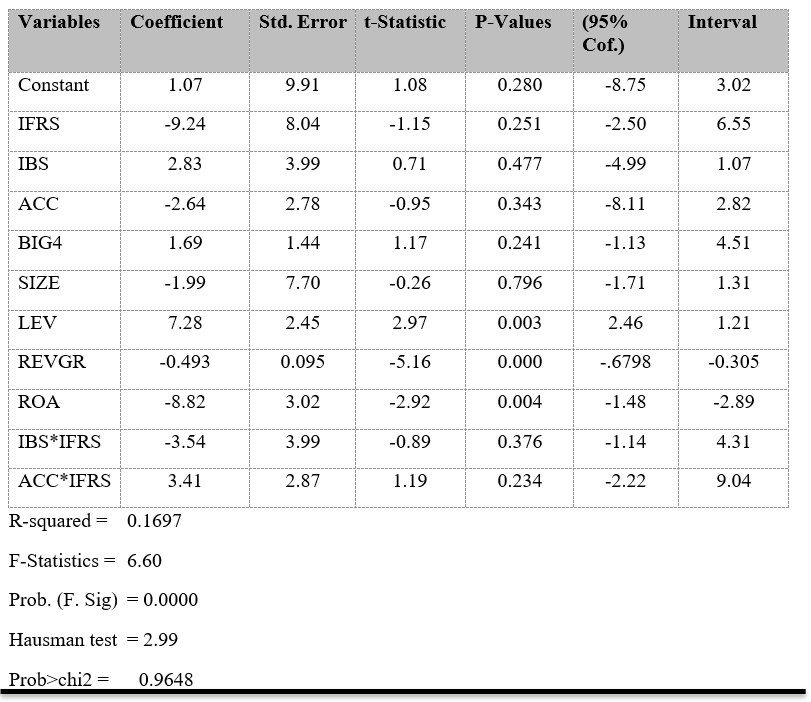

Table 4. Summary of Regression Result Robust

Source: Researchers computation (2024).

The comprehensive Ordinary Least Squares (OLS) regression findings illustrated in Table 4 unveil a cumulative R-squared value of 0.1697, representing the multiple coefficient of determination. This suggests that a combination of variables including Independent Board Size, Audit Committee Composition, Leverage, Firm Size, Return On Asset, Revenue Growth, and the interaction between IFRS (IBS*IFRS and ACC*IFRS) collectively explained about 17% of the systematic differences observed in earnings management practices within the manufacturing firms listed in Nigeria. Additionally, with an F-statistics value of 6.60, it indicates that the model fits well and is statistically significant at the 1% level. Consequently, the model is deemed suitable, demonstrating that the chosen explanatory variables are appropriately selected, integrated, and effectively utilized, attributing to the significant contribution of corporate governance. Hence, this research relies on the discovered findings.

The findings from Table 8, regression analysis indicate several key points. Firstly, the independent board size demonstrates a positive t-value of 0.71, indicating a positive correlation with earnings management in the absence of IFRS interaction. Conversely, the interaction term between independent board size and IFRS (IBS*IFRS) shows a negative correlation of -0.89, suggesting a significant association with earnings management practices. This suggests that both independent board size alone and its interaction with IFRS contribute to earnings manipulation in quoted manufacturing companies in Nigeria.

The findings further illustrate that the audit committee's composition, without involvement with IFRS, yields a negative t-value of -0.95, significant at the 5% level. This contrasts with the positive t-value of -1.19 observed after ACC interacts with IFRS (ACC*IFRS). This suggests that IFRS does not moderate the effect of audit committee composition, failing to mitigate instances of earnings management. Additionally, the results suggest that larger audit committee sizes correspond to a decreased likelihood of utilizing discretionary accruals. This may be a result of the silence of IFRS in providing a financial reporting framework and how the standards offer a choice concerning the composition of audit committee members.

With a t-value of 1.17, the BIG4 audit firm exhibits a positive yet modest significance concerning the control variables of earnings management within Nigerian manufacturing companies. This suggests that as audit quality improves, there is a corresponding decrease in earnings management. An additional reason for using high-quality audit work as a defense against earnings manipulation could be the greater capacity of Big 4 auditors to provide higher-quality and more professional qualitative services than non-Big 4 auditors. A t-value of -0.26, significant at the 1% level, indicates that company size has a negative and statistically significant impact on the degree of earnings management practices among Nigerian listed manufacturing firms. This means that a company is more likely to limit its use of profits management techniques as it grows. Additionally, with a t-value of 2.97 and a p-value of 0.003, the results indicate that leverage is positively and weakly correlated with listed manufacturing firms in Nigeria that practice earnings management. It can be inferred from this that organizations with lower leverage are less likely than those with higher leverage to manipulate earnings. On the level of earnings management, revenue growth (REVGR) seems to be having a negative and negligible effect. Ultimately, it was determined that, with a significance level of 1%, Return on Asset (ROA) exerted a positive and statistically significant impact on the earnings management technique.

The Hausman test was utilized to determine which model, either the fixed-effect or random-effect models, performed better. According to the Hausman test, the random-effect model emerges as the optimal choice, supported by a p-value (0.9648) exceeding the 0.05 significance threshold. Consequently, this study rejects the null hypothesis and upholds the random-effect model's outcome. This suggests that all pertinent predictors of earnings management in quoted manufacturing firms, as sought by the researcher, are incorporated in the study. However, it's essential to note that the applicability of random effects is confined to the experimental conditions.

4.4 Discussion

Given that the average earnings management prior to the adoption of IFRS (4.22) exceeds the average earnings management subsequent to IFRS adoption (-1.36), which infer a significant disparity in earnings management. These conclusions stem from the outcomes of a hypothesis test conducted in pursuit of research objective one. These findings align with previous studies by Fallatah (2021), Key & Kim (2020), Barth et al. (2008), and Rahmellia (2009), all of whom observed a decline in earnings management following the transition to IFRS compared to preceding periods. However, these results are contrary to those of Xu (2014), and Leuz et al. (2003), who suggested that the adoption of IFRS doesn't consistently mitigate earnings management practices.

The adoption of IFRS appears to be influenced by the size of the independent board, according to the findings of the hypothesis tested which aligned with research objective. But according to the study, there is no situation in which the adoption of IFRS has a major impact on earnings management because of the size of the independent board alone. When taken out of the context of IFRS, the results show a weak positive link (0.71) between the size of the independent board and earnings management. On the other hand, a negative association (-0.89) is seen when taking into consideration the interaction between independent board size and IFRS (IBS*IFRS), albeit one that is statistically insignificant. These findings suggest that, in the existence of an independent board size, the required adoption of IFRS has no effect on reducing earnings management. As a result, it implies that among quoted manufacturing companies in Nigeria, a greater number of independent directors is associated with a higher risk of participating in earnings manipulation activities. This suggests that the size of the independent board has no bearing on the methods used by listed Nigerian industrial companies to manage their earnings. This finding is consistent with earlier research by Saona et al. (2020), Azzam (2020), Azeez et al. (2019), Amran et al. (2016), and Idris et al. (2018), which discovered in a similar manner that a board with a higher percentage of independent directors is generally more successful in limiting earnings management practices.

Based on the outcomes of the hypothesis test aligned with research objective, it is further evidence that the size of the audit committee does not significantly influence the differential impact of IFRS adoption on earnings management. Initially, the audit committee composition exhibited a negative correlation (-0.95) and significant at a 5% level of significance prior to its interaction with IFRS. On the contrary, subsequent to the adoption of IFRS, there is a notable positive correlation (1.19) observed in the change in position (ACC*IFRS), indicating statistical significance regarding earnings management. This suggests that the integration of IFRS does not moderate the impact of audit committee composition within the realm of listed manufacturing firms in Nigeria. Consequently, the composition of the audit committee doesn't significantly influence the practice of earnings management. Thus, the study does not refute the third null hypothesis, indicating that the interplay between audit committee composition and IFRS (ACC*IFRS) might not alleviate instances of earnings management. These results are consistent with earlier studies by Jatiningrum et al. (2020), Setiawan, Phua, Chee, and Trinugroho (2020), indicating that audit committee size does not play a role in reducing earnings management., which similarly highlight a negative association between committee size and earnings management following the interaction of audit committee composition with IFRS (ACC*IFRS). This observation may be attributed to the similarities between IFRS and local GAAP accounting policies regarding audit committee composition.

Based on the results of a hypothesis test aligned with research objective four, the analysis regarding the moderating impact of IFRS on earnings management suggests that there was no significant interaction observed among listed manufacturing firms in Nigeria. This indicates that the interplay between these variables does not exert a notable influence on earnings management. Consequently, investors need not overly concern themselves with the potential moderating effect of IFRS on earnings management within quoted manufacturing firms in Nigeria. One possible explanation for this finding could be that, despite being a principle-based accounting standard, IFRS exhibits minimal deviation from NGAAP, a rule-based accounting standard. Notably, when considered in isolation, IFRS was found to have a statistically significant negative impact at the 1% level, indicating that IFRS alone cannot effectively deter earnings manipulation in quoted manufacturing firms in Nigeria. This aligns with studies of Callaoa and Jarnea (2010), Domenico and Ray (2011), and Li and Park (2012), which also provided empirical evidence suggesting that corporate governance lacks the ability to sufficiently curtail earnings manipulation in corporations.

5. Conclusion

It is clear from the data analysis that corporate governance practices more especially, the makeup of audit committees and the size of independent boards as well as the application of IFRS have a negative impact on earnings management. As a result, under IFRS, there is a negative link between the number of independent directors and the makeup of audit committees. In line with the first goal, the research confirms a significant difference between publicly traded companies' earnings management practices before and after the implementation of International Financial Reporting Standards. T-test results support the alternative hypothesis, showing a significant decline in earnings management after IFRS adoption relative to the pre-implementation period.

Furthermore, considering IFRS interaction, the size of the independent Board is the only factor that significantly influences the drop in management practices during the period of IFRS implementation. Stakeholder theory's premise that small numbers are efficient leads to the possibility that companies with a smaller audit committee membership may be more conservative with their profits management. This may be the case since the capacity and ability of other shareholder classes to abstain from controlling earnings will significantly enhance the capacity and capability of overseeing management. Inversely, it is apparent that leverage is not viable control variable as it reveals insignificant p-value. The study concludes that IFRS adoption does not significantly moderate the relationship between corporate governance and earnings management of Nigerian manufacturing firms to abstain from the menace of earnings manipulation.

Acknowledgments

My utmost appreciation goes to God almighty for His love and guidance, His unending favour, blessings and love and inspirations at every stage of this research work, without Him, I wouldn’t have made it to this successful end.

In addition, I deeply appreciate my project supervisor, Dr. S. Abogun, for her intellectual contribution, motivation, and support towards the successful completion of this research.

I also would like to thank all the lecturers in the Department of Accounting, Prof. A. S. Kasum, Prof. Olubunmi F. Osemene, Prof. T. A. Olaniyi, Prof. Khadijat A. Yahaya, Dr. Rahmat T. Salman, Dr. E. A. Adigbole, Dr. L. Aliu, Dr. D. Bamigbade, Mr. A. Dauda, Miss G. Fakile; Department of Finance, Prof. M. A. Ijaiya, Prof I. B. Abdullahi, Dr. M. A. Ajayi, Dr. Rihanat I. Abdulkadir, Dr. A.A. Abdulraheem, Dr. A.T. Jimoh, Dr. Fatimah M. Etudaiye, Dr. K. Kayode, the Post Graduate Coordinator, Dr. E. A. Adigbole, the Sub-Dean and the Dean of the Faculty of Management Sciences, Dr. A. T. Jimoh and Prof. R. A. Gbadeyan respectively as well as all the non-teaching staff of the Department of Accounting and the Faculty of Management Sciences at large.

My gratitude knows no bounds to my parents Mr. and Mrs. Abdullahi for their discipline, good parental care, training, support and prayers without which I wouldn’t have been what I am; my appreciation also goes to my wife for her support which has been the pillar which I lean on, thank you for being there. A limitless thanks goes to my siblings, head of unit at work, my team mates, my friends and my course mate during the programme for their support and advice.

Finally, I also acknowledged with thanks the authors of various reference materials cited on this study.

References

Abdullahi, R., & Mansor, N. (2015). Fraud Triangle Theory and Fraud Diamond Theory. Understanding the Convergent and Divergent For Future Research, European Journal of Business and Management, 5(4), 38–45.

Abogun, S., Aiyenijo, E., & Adigbole, A. (2021). Income smoothing and firm value in a regulated market: The moderating effect of market risk. Asian Journal of Accounting Research, 6(3), 296–308.

Aisha, A. (2021). The impact of board of director characteristics on earning management in the real estate companies listed United Arab Emirates. Academy of Accounting and Financial Studies Journal, 25(1), 50–59.

Alfadhael, S. A., & Jarraya, B. (2021). Earnings management and its applications in Saudi Arabia context: Conceptual framework and literature review. Accounting (North Vancouver), 2(1), 993–1008.

Amran, N. A., Ishak, R., & Manaf, K. A. (2016). The influence of real earnings on Malaysian corporate board structure. The Social Sciences, 11(30), 7258–7262.

Al Azeez, H. A. R., Sukoharsono, E. G., & Andayani, W. (2019). The impact of board characteristics on earnings management in the international oil and gas corporations. Academy of Accounting and Financial Studies Journal, 23(1), 1–26.

Azzam, M. (2020). The association between corporate governance reform and earnings management: empirical evidence from a unique regulatory environment. International Journal of Accounting, Auditing and Performance Evaluation, 16(2–3), 149–199.

Barth, M. E., Landsman, W. R., & Lang, M. H. (2008). International accounting standards and accounting quality. Journal of Accounting Research, 46(3), 467–498.

Bebuck, L., Smith, J., & Johnson, K. (2000). The impact of corporate governance on financial performance. Journal of Business Studies, 30(2), 145–155.

Callao, S., & Jarne, J. I. (2010). Have IFRS Affected Earnings Management in the European Union? Accounting in Europe, 7(2), 159–189.

Dechow, P., Sloan, R., & Sweeney, A. (1995). Detecting earnings management. The Accounting Review, 70(1), 193–225.

Domenico, C., & Ray, D. (2011). The Impact of corporate governance and the adoption of IFRS on earnings quality in different legal jurisdictions: A comparison between Italy and the UK. Working Paper.

Dong, N., Wang, F., Zhang, J., & Zhou, J. (2020). Ownership structure and real earnings management: Evidence from China. Journal of Accounting and Public Policy, 39(3), 106733.

Effiok, S. O., Effiong, C., & Usoro, A. A. (2012). Corporate governance, corporate strategy and corporate performance: evidence from the financial institutions listed on the Nigerian Exchange Group (NGX). European Journal of Business and Management, 4, 84–95.

Fallatah, R. (2021). Earning management and the independence of board of directors: A study of financial sectors in Saudi Arabia. Academy of Accounting and Financial Studies Journal, 25(1), 1–9.

Goncharov, I., & Zimmermann, J. (2006). Earnings management when incentives compete: The role of tax accounting in Russia. Journal of International Accounting Research, 5(1), 41–65.

Hamdan, A. (2020). The role of the audit committee in improving earnings quality: The case of industrial companies in GCC. Journal of International Studies, 13(2), 127–138.

Hasan, M. T., & Rahman, A. A. (2020). The role of corporate governance on the relationship between IFRS adoption and earnings management: evidence from Bangladesh. International Journal of Financial Research, 11(4), 329.

Healy, P., & Wahlen, J. (1999). A review of the earnings management literature and its implications for standard setting. Accounting Horizons, 13(1), 365–383.

Hirshleifer, D., Hou, K., & Teoh, S. H. (2009). Accruals, cash flows, and aggregate stock returns. Journal of Financial Economics, 91(3), 389–406.

Hribar, P., & Collins, D. W. (2002). Errors in Estimating Accruals: Implications for Empirical Research. Journal of Accounting Research, 40(1), 105–134.

Idris, M. I., Siam, Y. I. A., & Ahmad, A. L. (2018). The impact of external auditor size on the relationship between audit committee effectiveness and earnings management. Investment Management and Financial Innovations, 15(3), 122–130.

Jatiningrum, C., Fauzi, R. I., & Mujiyati, S. H. (2020). An investigation on the effect of audit committee on financial reporting quality in pre and post IFRS adoption: Evidence from Malaysian companies. Humanities & Social Sciences Reviews, 8(02), 25–35.

Jensen, M., & Meckling, W. (1976). Theory of the firm: Managerial behavior, agency costs and ownership structure. Journal of Financial Economics, 3(1), 305–360.

Onuoha, J. O., Joshua, O., Sarutu, J. S., & Agbi, S. (2021). Board diversity and earnings quality of listed deposit money banks in Nigeria. Journal of Finance and Accounting, 9(1), 11–31.

Key, K. G., & Kim, J. Y. (2020). IFRS and accounting quality: Additional evidence from Korea. Journal of International Accounting, Auditing and Taxation, 2(1), 100–306.

Kurawa, M. J., & Ahmed, I. (2020). Audit quality and earnings management of listed non-financial companies in Nigeria. Global Scientific Journal, 8(7), 105–123.

Leuz, C., Nanda, D., & Wysocki, P. (2003). Earnings management and investor protection: An international comparison. Journal of Financial Economics, 69(1), 505–527.

Liu, C., Yao, L., Hu, N., & Liu, L. (2012). The impact of IFRS on accounting quality in a regulated market: An empirical study of China. Journal of Accounting, Auditing and Finance, 26(4), 659–676.

Kang, Q., Liu, Q., & Qi, R. (2010). Predicting stock market returns with aggregate discretionary accruals. Journal of Accounting Research, 48(4), 815–858.

Cormier, D., & Martinez, I. (2006). The association between management earnings forecasts, earnings management, and stock market valuation: Evidence from French IPOs. The International Journal of Accounting, 41(3), 209–236.

Malo-Alain, A., Melegy, M., & Ghoneim, M. (2019). The effects of sustainability disclosure on the quality of financial reports in Saudi business environment. Academy of Accounting and Financial Studies Journal, 1(1), 23.

Nik, M. Z., & Hassan, C. H. (2014). Audit committee and earnings management: Pre and post MCCG. International Review of Management and Business Research, 3(1), 307–318.

Olufemi, A. (2021). Board gender diversity and performance of listed deposit banks in Nigeria. European Business & Management, 7(1), 14–23.

Saona, P., Muro, L., & Alvarado, M. (2020). How do the ownership structure and board of directors' features impact earnings management? The Spanish case. Journal of International Financial Management and Accounting, 31(1), 98–133.

Setiawan, D., Taib, F., Phua, L. K., & Chee, H. K. (2020). IFRS, family ownership and earnings management in the Indonesian banking industry. International Journal of Economics & Management, 20(1), 37–58.

Tawia, V., & Boolaki, P. (2020). A review of literature on IFRS in Africa. Journal of Accounting and Organization Change, 16(1), 47–70.

Recebido: 26/03/2025

Aceito: 01/04/2025

------------

Notas

[1] University of Ilorin, Ilorin, Nigeria, https://orcid.org/0000-0002-1765-5674 E-mail: jesussaves@unilorin.edu.ng

[2] University of Ilorin, Ilorin, Nigeria, https://orcid.org/0009-0001-3986-2148 E-mail: a.nasirudeen@yahoo.com

[3] University of Ilorin, Ilorin, Nigeria, https://orcid.org/0000-0001-7786-4577 E-mail: salman.rt@unilorin.edu.ng

[4] University of Ilorin, Ilorin, Nigeria, https://orcid.org/0009-0001-3435-2165 E-mail: orilonise.ma@unilorin.edu.ng