Dinâmica de consumo, comportamento da taxa de juros a equação de euler: evidência de séries temporais em nigéria

DOI:

https://doi.org/10.24212/2179-3565.2017v8i2p151-169Palavras-chave:

Consumo, Taxa de juros real, inflação, VAR, NigériaResumo

O trabalho analçisa a Relação de Euler referente a consumo-taxa de juros para a Nigéria nos períodos de 1980 a 2015. Aplicando técnicas comumente utilizadas de Autoregresão Vectorial (VAR) com dados anuais obtidos para o país, o estudo encontrou que existe a relação Euler de Consumo-Taxa de Juros em Nigéria. Porem a analise realziada rejeitou a afirmação geral dos teoricistas de que o efeito de substituição é sempre maior (e mais viável) na relação de Euler do que o efeito de renda. Nossos resultados indicam que a equação de Euler de consumo para a Nigéria é impulsionada pelo consumo, uma indicação de que o efeito de renda pode ser mais viável na Nigéria assim eliminando o efeito de substituição. Isto foi ainda confirmado pela existencia de uma causalidade unidirecional que vai do consumo para a taxa de juros. Isso sugere, entre outras coisas, utilizar um framework na política de taxas de juros que seja flexível às necessidades econômicas da região, e motive a cultura dos padrões de consumo nas pessoas de poupança-gasto financiada por produtos financeiros sem dinheiro.

Downloads

Publicado

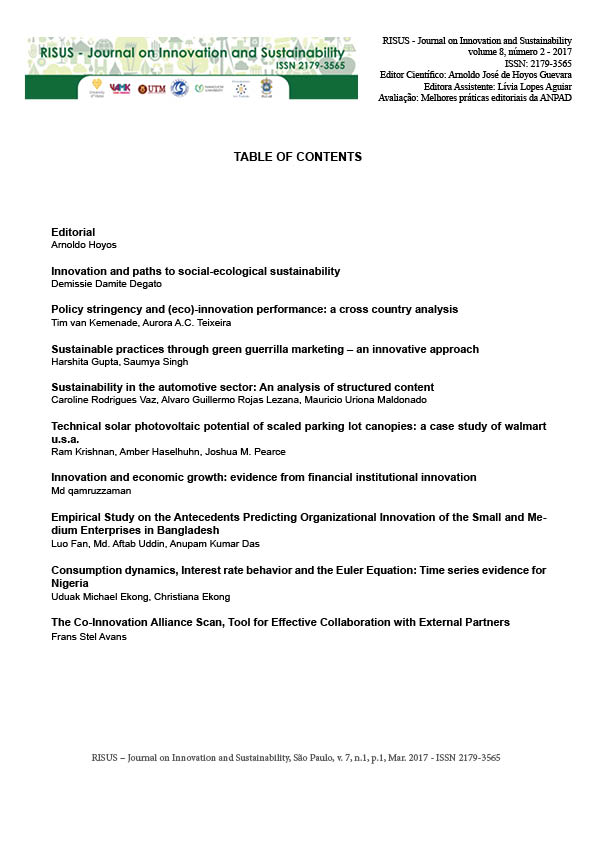

Edição

Seção

Licença

Esta obra está licenciada sob uma licença Creative Commons Atribuição - No comercial - Sin derivaciones 4.0 Internacional

1.O(s) autor(es) autoriza(m) a publicação do artigo na revista;

2.O(s) autor(es) garante(m) que a contribuição é original e inédita e que não está em processo de avaliação em outra(s) revista(s);

3.A revista não se responsabiliza pelas opiniões, ideias e conceitos emitidos nos textos, por serem de inteira responsabilidade de seu(s) autor(es);

4.É reservado aos editores o direito de proceder ajustes textuais e de adequação do artigos às normas da publicação.

1.1 Copyright Statement

This journal is licensed under a Creative Commons Attribution-Non Commercial-No Derivers 4.0 International license.

1. The author (s) authorize the publication of the article in the journal;

2. The author (s) warrant that the contribution is original and unpublished and is not in the process of being evaluated in other journal (s);

3. The journal is not responsible for the opinions, ideas and concepts emitted in the texts, as they are the sole responsibility of its author (s);

4. The editors are entitled to make textual adjustments and to adapt the articles to the standards of publication.