Taxation, Inequality, and the Illusion of the Social Contract in Brazil

Palavras-chave:

Tributação, Ilusão Fiscal, DesigualdadeResumo

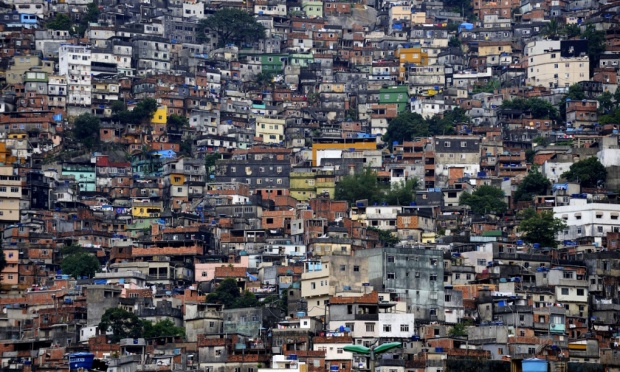

Brazil combines high inequality and high tax yield as percentage of the GDP. This situation contradicts the predictions of two central theories of taxation and democratic politics. The first theory predicts that, within a democratic context, high levels of income inequality should lead governments to carry out significant redistribution. The second theory sees the government’s ability to raise tax revenue as dependent on a social contract between the state and its citizens, and predicts a negative relationship between taxation and social polarization. In this paper, we propose that the theory of fiscal illusion can account for this double puzzle.

Métricas

Referências

Afonso, J. R. (2015) “O cúmulo da cumulatividade”, Instituto de Estudos para o Desenvolvimento Industrial – IEDI, retrieved from http://retaguarda.iedi.org.br/midias/artigos/54a7139a5d550ac4.pdf

Afonso, J, R., Soares, J. M. and Castro, K. P. (2013) ‘Avaliação da estrutura e do desempenho do sistema tributário brasileiro: livro branco da tributação brasileira’, Documento para Discussão IDB-DP-265, Washington, DC: Banco Interamericano de Desenvolvimento.

Alesina, A. and Rodrik, D. (1994) ‘Distributive politics and economic Growth’, The Quarterly Journal of Economics, Vol. 92, No. 2.

Alston, L., Melo, J. M., Muller, B. and Pereira, C. (2012) ‘Changing Social Contracts: beliefs and dissipative inclusion in Brazil’, NBER Working Paper No. 18588, Cambridge, MA: National Bureau of Economic Research.

Amaral, G. L., Olenike, J. E., Amaral, L. M., and Steinbruch (2009) ‘Estudo sobre sonegação fiscal das empresas brasileiras’, Curitiba: Instituto Brasileiro de Planejamento Tributário – IBPT.

Amaral, G. L., Olenike, J. E., Steinbruch, F., and Amaral, L. M. (2010) ‘Quantidade de normas editadas no Brasil: 22 anos da constituição federal de 1988”, Curitiba: Instituto Brasileiro de Planejamento Tributário – IBPT.

Araújo, J. M. and Siqueira, R. B. (2014) ‘Demanda por gastos públicos locais: evidências dos efeitos de ilusão fiscal no Brasil’, 42° Encontro Nacional de Economia. Natal, dezembro.

Breceda, K., Rigolini, J. and Saavedra, J. (2008), ‘Latin America and the social contract: patterns of social spending and taxation”, Discussion Paper WPS4604, Washington, DC: The World Bank.

Buchanan, J. M. (1960) Fiscal Theory and Political Economy, Chapel Hill: The University of North Carolina Press,

Buchanan, J. M. (1967) Public Finance in Democratic Process: Fiscal Institutions and Individual Choice, Chapel Hill: University of North Carolina Press.

Buchanan, J. M. and Wagner, R. E. (1977) Democracy in Deficit: The Political Legacy of Lord Keynes, New York: The Academic Press.

Bucheli, M., Lustig, N., Rossi, M. and Amábile, F. (2013) ‘Social spending, taxes and income redistribution in Uruguay”, CEQ Working Paper No. 10, Tulane University.

Coelho, I. (2014) “Um novo ICMS – princípios para reforma da tributação do Consumo”, Revista Brasileira de Comércio Exterior, No. 120.

Dell'Anno, R. and Mourão, P. (2012) ‘Fiscal illusion around the world: an analysis using the structural equation approach’, Public Finance Review, Vol. 40, No. 2.

Eusepi, G. (2006) ‘Public finance and welfare: from the ignorance of the veil to the veil of ignorance’, Journal of Economic Behavior and Organization, Vol. 59, No. 4.

Everest-Phillips, M. (2010) ‘State-building taxation for developing countries: principles for reform’, Development Policy Review, Vol. 28, No. 1.

Everest-Phillips, M. (2011) ‘Tax, governance and development’, Commonwealth Secretariat Discussion Paper No. 11, London: Commonwealth Secretariat.

Fasiani, M. (1941) Principii di Scienza delle Finanze, Vol. I, Torino: Giappichelli.

Fukuyama, F. (2011) The Origins of Political Order: From Prehuman Times to the French Revolution, New York: Farrar, Straus and Giroux.

Giambiagi, F. and Além, C. (2008) Finanças Públicas: Teoria e Prática no Brasil. Rio de Janeiro: Campus.

Higgins, S. and Pereira, C. (2013) ‘The effects of Brazil’s high taxation and social spending on the distribution of household spending’, CEQ Working Paper No. 7, Tulane University.

Immervoll, H., Levy, H., Nogueira, J. R. B., O’Donoghue, C., and Siqueira, R. B. (2006) ‘Simulating Brazil’s tax-benefit system using BRAHMS, the brazilian household microsimulation model’, Economia Aplicada, Vol. 10, No. 2.

Immervoll, H., Levy, H., Nogueira, J. R. B., O’Donoghue, C., and Siqueira, R. B. (2009) ‘The impact of Brazil’s tax-benefit system on inequality and poverty’, in S. Klasen and Nowak-Lehmann (eds.), Poverty, Inequality, and Policy in Latin America, Cambridge: MIT Press.

Lisboa, M. B. and Latif, Z. A (2013) ‘Democracy and growth in Brazil’, Insper Working Paper WPE: 311/2013, São Paulo: Instituto de Ensino e Pesquisa - INSPER.

Luebker, M. (2011) ‘The impact of taxes and transfers on inequality’, Travail Policy Brief No. 4, Geneva: International Labour Office.

Lustig, N., López-Calva , L. and Ortiz-Juarez, E. (2012) ‘Declining inequality in Latin America in the 2000s: the cases of Argentina, Brazil, and Mexico’, World Bank Policy Research Working Paper No. 6248, Washington, DC : The World Bank.

Mattos, E., Rocha, F. and Avarte, P. (2011) ‘Flypaper effect revisited: evidence for tax collection efficiency in brazilian municipalities’, Estudos Econômicos, Vol. 41, No. 2.

Meltzer, A. and Richard, S. (1981) ‘A rational theory of the size of government’, Journal of Political Economy, Vol. 89, No. 5.

Moore, M. (2004) ‘Revenues, state formation, and the quality of governance in developing countries”, International Political Science Review, Vol. 25, No. 3.

Mourão, P. (2007) ‘The economics of illusion: a discussion based in fiscal illusion’’, Journal of Public Finance and Public Choice, Vol. 25, No. 1.

Mourão, P. (2010) ‘Fiscal illusion causes fiscal delusion – please be careful’, in S. T. Magalhães, H. Jahankhani, and A. G. Hessami (eds.), Global Security, Safety, and Sustainability, Vol. 92, Heidelberg: Springer.

Oates, W. E. (1988) ‘On the nature and measurement of fiscal illusion: a survey”, in G. Brennan, B. S. Grewel and P. Groenwegen (eds.), Taxation and Fiscal Federalism: Essays in Honour of Russell Mathews, Sydney: Australia University Press.

Organization for Economic Cooperation and Development - OECD (2008) Governance, Taxation and Accountability: Issues and Practices, DAC Guidelines and Reference Series, Paris: OECD DAC.

Paulus, A. et al. (2009) ‘The effects of taxes and benefits on income distribution in the enlarged EU’, EUROMOD Working Paper No. EM8/09, Institute for Social and Economic Research, Colchester: University of Essex.

Pessoa, S. (2011) ‘O Contrato Social da Redemocratização’, in E. L. Bacha and S. Schwartzman (org.), Brasil: A Nova Agenda Social, Rio de Janeiro: LTC.

Prichard, W. (2010) ‘Taxation and state building: towards a governance focused tax reform agenda”, IDS Working Paper 341, Brighton: Institute of Development Studies.

Puviani, A. (1903) Teoria Dell’illusione Finanziaria, Milan: Remo Sandon.

PwC (2012) Paying taxes 2013: The Global Picture, Washington, DC.: PricewaterhouseCoopers International Limited and The World Bank.

Sakurai. S. N. (2013) ‘Efeitos assimétricos das transferências governamentais sobre os gastos públicos locais: evidências em painel para os municípios brasileiros’, Pesquisa e Planejamento Econômico, Vol. 43, No. 2.

Sausgruber, R. and Tyran, J. (2005) ‘Testing the Mill hypothesis of fiscal Illusion’, Public Choice, Vol. 122, No. 1.

Schumpeter, J. A. (1918) ‘The crisis of the tax state’, in J. A. Schumpeter, The Economics and Sociology of Capitalism, R. Swedberg (ed.), 1954, New Jersey: Princeton University Press.

Secretaria da Receita Federal - SRF (2014) Carga Tributária no Brasil 2013, Brasília: Secretaria da Receita Federal.

Sen, A., 1999, Development as Freedom, New York: Alfred Knopf.

Silva, A. M. A. and Siqueira, R.B. (2014) ‘Demanda por gasto público no Brasil no período pós-redemocratização: testes da lei de Wagner e da hipótese de Mill de ilusão fiscal”, Pesquisa e Planejamento Econômico, No. 43, July-December.

Silveira, F. G. (2012) ‘Equidade fiscal: impactos distributivos da tributação e do gasto social’, XVII Prêmio Tesouro Nacional, Brasília: Secretaria do Tesouro Nacional.

Siqueira, R. B., Nogueira, J. R. and Souza, E. S. (2001) ‘A incidência final dos impostos Indiretos no Brasil: efeitos da tributação de insumos’, Revista Brasileira de Economia, Vol. 55, No. 4.

Siqueira, R. B., Nogueira, J. R. and Souza, E. S. (2012) ‘Alíquotas efetivas e a distribuição da carga tributária indireta entre as famílias no Brasil’, in XV Prêmio Tesouro Nacional - 2010: Homenagem a Joaquim Nabuco, Brasília: Secretaria do Tesouro Nacional

Siqueira, R. B., Nogueira, J. R. and Souza, E. S. (2014) ‘Is the brazilian tax system regressive?’, EconomiA, Associação Nacional dos Centros de Pós-Graduação em Economia – ANPEC, forthcoming.

Sokoloff K. L. and Zolt, E. M. (2007) ‘Inequality and the evolution of institutions of taxation’, in S. Edwards, G. Esquivel and G. Márquez (eds), The Decline of Latin American Economies: Growth, Institutions, and Crises, Chicago: University of Chicago Press.

Pedro Ferreira de Souza and Marcelo Medeiros and Fabio A. Castro (2015) ‘Top incomes in Brazil: preliminary results’, Economics Bulletin, Vol. 35, No. 2.

Souza, M. M. (2012) ‘Gasto público, tributos e desigualdade de renda no Brasil’, XVII Prêmio Tesouro Nacional – 2012, Brasília: Secretaria do Tesouro Nacional.

Tanzi, V. (2011) Government versus Market: The Changing Economic Role of the State, Cambridge: Cambridge University Press.

The Economist (2005) ‘Simpler taxes: the flat-tax revolution’, April 16th, London.

von Haldenweng, C. (2008) ‘Taxation, social cohesion and fiscal descentralization in Latin America’, Discussion Paper 1/2008, Bonn: German Development Institute.

von Stein, L. (1885) ‘On taxation’, in R. A. Musgrave and A. Peacock (eds.), Classics in the Theory of Public Finance, 1958, London: Macmillan.

Wagner, R. E. (2001) ‘From the politics of illusion to the high cost of regulation’, Of Public Interest, Vol. 3, No. 8.