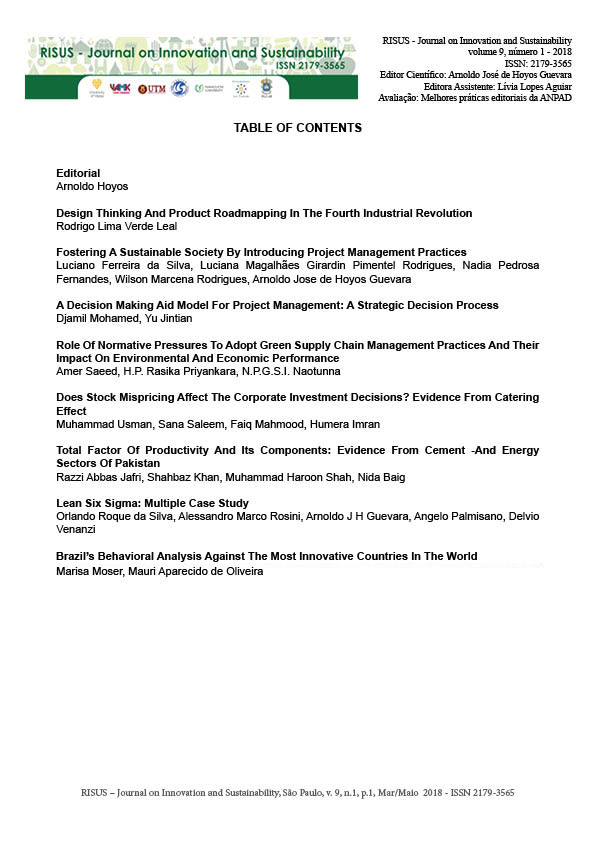

DOES STOCK MISPRICING AFFECT THE CORPORATE INVESTMENT DECISIONS? EVIDENCE FROM CATERING EFFECT

DOI:

https://doi.org/10.24212/2179-3565.2018v9i1p43-54Palabras clave:

Stock mispricing, corporate investment, Investment horizonResumen

Current study finds out the effect of stock mispricing, through catering effect, on corporate investment decisions by taking the sample of firms listed on Pakistan Stock Exchange during the period of 2007-2014. This study uses the methodology of Rhodes-Kropf et al (2005) to measure the stock mispricing who used market to book decomposition methodology to find out different components of mispricing and relate it to corporate investment activity that is measured by capital expenditures. Stockholder investment horizon is measured by share turnover ratio. Panel regression methodology is used to determine the relationship between stock mispricing and corporate investment decisions. Results of the study show that Firms with short horizon investors have significantly higher mispricing sensitivity than the firms with long horizon shareholder. Both sides of mispricing affect the investment but the impact of overvaluation is more than undervaluation because the firms issue shareholder equity more than stock repurchase.Descargas

Publicado

2018-03-01

Número

Sección

Papers

Licencia

This Journal is licensed under a Creative Commons Attribution-Non Commercial-No Derivers 4.0 International license.

1.The author (s) authorize the publication of the article in the journal;

2.The author (s) warrant that the contribution is original and unpublished and is not in the process of being evaluated in other journal (s);

3. The journal is not responsible for the opinions, ideas and concepts emitted in the texts, as they are the sole responsibility of its author (s);

4. The editors are entitled to make textual adjustments and to adapt the articles to the standards of publication.